Advertisement|Remove ads.

IREN Stock Hits Fresh All-Time Highs As AI Infrastructure Demand Picks Up: Retail Chatter Explodes

IREN (IREN) stock hit a new all-time high of $70.87 on Tuesday as continuous interest in the company’s artificial intelligence infrastructure and positive business growth fueled optimism among investors.

Cantor Fitzgerald has lifted its price target on the stock to $100 from $49, while maintaining an ‘Overweight’ rating, according to TheFly. The firm highlighted that IREN has “heavily leaned into” its AI cloud services in recent months, positioning the company to move beyond its legacy operations.

The firm further noted that IREN’s shift toward cloud infrastructure mirrors peers like CoreWeave and asserted that the company still has runway to grow despite recent gains.

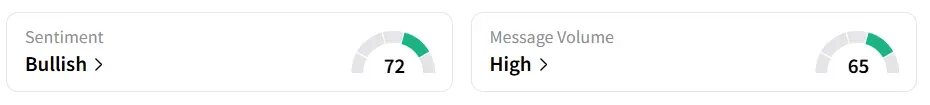

At the time of writing, IREN stock pared some of the gains and traded over 10% higher on Tuesday afternoon. On Stocktwits, retail sentiment around the stock shifted to ‘bullish’ from ‘extremely bullish’ territory the previous day amid ‘high’ message volume levels.

The stock experienced a 1,368% surge in user messages over 24 hours as of Tuesday morning.

On a contracted megawatt basis, IREN’s shares currently trade at a steep discount, about 75% lower compared to its neocloud peers, according to Cantor. The firm projects that this gap will narrow over time. Cantor stated that the firm’s access to land, power capacity, capital, and data center know-how gives it a structural advantage.

Meanwhile, BTIG raised its own price target on IREN to $75 from $32 while retaining a ‘Buy’ rating. The firm points to rising demand for prompt power from neoclouds and hyperscalers as a continuing tailwind for firms like IREN.

IREN stock has gained 616% in 2025 and over 724% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)