Advertisement|Remove ads.

Trilogy Metals Stock Hits Fresh All-Time Highs On Optimism Around US Government’s Stake In The Company

Trilogy Metals stock (TMQ) hit a fresh all-time high of $11.29 on Tuesday as the stock continued to remain in the spotlight after the U.S. government agreed to buy a 10% stake in the company.

The escalation in U.S.-China trade animosity, with China planning to impose rare earth export curbs and the U.S. responding with massive tariff hikes, is also contributing to the stock's upward momentum.

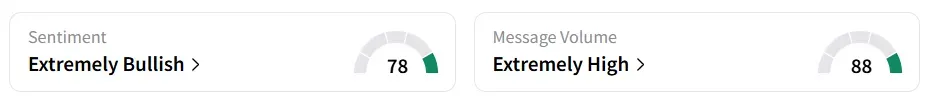

At the time of writing, Trilogy Metals’ stock pared some of the gains and traded over 50% higher. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

The stock experienced a 392% increase in user message count in 24 hours as of Tuesday morning. A bullish Stocktwits user expressed optimism about the government’s stake in the company.

Another user highlighted the importance of critical metals in AI and quantum computing.

The Trump administration agreed to purchase 8.2 million shares of Trilogy Metals at $2.17 each from South32, an Australian company. The U.S. government also has the option to acquire an additional 7.5% stake in the company in the future. This deal was part of a larger $35.6 million investment in important energy projects in Alaska.

The administration also approved the Ambler Road Project, a proposed 211-mile industrial road from the Dalton Highway to Alaska’s remote Ambler Mining District (District) that would enable access to large deposits of copper, cobalt, gallium, germanium, and more.

Trilogy Metals has a 50% interest in Ambler Metals LLC, which has a 100% interest in the Upper Kobuk Mineral Projects (UKMP) in northwestern Alaska.

Trilogy Metals' stock has gained over 736% in 2025 and over 1,757% in the last 12 months.

Also See: Nvidia’s DGX Spark Lands At Starship HQ As Jensen Huang Hand-Delivers It To Elon Musk

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)