Advertisement|Remove ads.

Is The Nasdaq Composite Getting Ready For A Short-Term Correction? Chart Shows A Lower High And Approach Toward 50-DMA

- Friday’s decline was fueled by sharp selling in technology shares, including Broadcom, NVIDIA, and AMD.

- The index is on track to open higher on Monday as major heavyweights appear set for a rebound.

- Commentary from several Federal Reserve officials and key macro data, including the employment report, are expected this week.

The Nasdaq Composite Index fell more than 1.7% to 23,195.17 on Friday, testing a key short-term support at the 50-day moving average (50-DMA) for the first time in nearly three weeks.

Notably, the index formed a lower high of around 23,700 last Wednesday on the daily chart, compared to its peak of around 24,020 formed on October 29.

What matters now is whether the index will rebound from the 50-DMA or will fail to hold above the line in the coming days. A convincing move below the line on the daily charts is usually considered negative in the short-term.

What Triggered The Selloff?

The decline was fueled by sharp selling in technology shares, which dominate the index, accounting for more than 62% of its weight as of Dec. 12, 2025.

Broadcom (AVGO) shares slumped more than 11% on Friday despite better-than-expected fourth-quarter revenue and earnings, as market participants focused on margin pressures. Advanced Micro Devices (AMD) shed nearly 5%, NVIDIA declined more than 3%, Micron Technology (MU) slid 6.7%, while Intel Corp. (INTC) fell 4.3% on Friday.

How Does Monday’s Premarket Shape Up?

After Friday’s sharp intraday decline, the index is on track to open higher on Monday, as major heavyweights climbed in premarket trading.

NVIDIA was up 1.17%, Apple climbed 0.2% higher, Tesla rose 1.1%, Amazon was up 0.5%, Alphabet gained 0.8%, META advanced 0.2%, Broadcom was up 0.7%, while Microsoft stock was largely unchanged.

Events To Watch Out For This Week

Markets are gearing up for a data-packed week alongside commentary from several Federal Reserve officials, including Governors Stephen Miran and Chris Waller, New York Fed President John Williams, and Atlanta Fed President Raphael Bostic.

The Fed cut interest rates by 25 basis points last week to a 3.5% - 3.75% range, the lowest since October 2022, in a split decision that exposed sharp internal divisions. Chicago Fed President Austan Goolsbee and Kansas City Fed President Jeffrey Schmid voted to hold rates steady, while newly appointed, Trump-nominated Miran argued for a larger 50-basis-point cut.

Investors will also focus on the delayed U.S. employment report, the unemployment rate, and November CPI data for clues on the policy outlook.

How Did Stocktwits Users React?

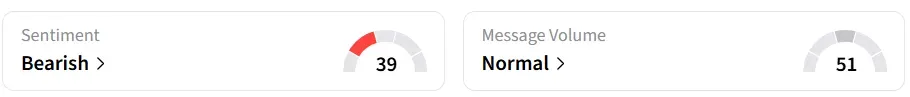

Retail sentiment on Stocktwits turned ‘bearish’ from ‘neutral’ a day earlier.

Year-to-date, the index has gained around 20%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)