Advertisement|Remove ads.

iTeos Therapeutics To Wind Down Operations, Explores Asset Sale: Retail Believes It’s ‘Worth More Selling It Off’

Shares of biopharmaceutical company iTeos Therapeutics, Inc. (ITOS) traded 20% higher on Wednesday morning after the company announced its intent to wind down operations and explore asset sales.

iTeos said it decided to wind down operations as part of a review of strategic alternatives aimed at maximizing shareholder value.

The Board of Directors now intends to focus on leveraging the company’s cash balance to deliver near-term value to shareholders, including any proceeds from the potential sale of the company’s intellectual property and assets.

iTeos ended the first quarter of 2025 with cash and investments of $624.3 million. Last month, the firm had said that it expects its cash balance to provide a runway through 2027.

However, earlier this month, iTeos decided to terminate its collaboration with British pharmaceutical major GSK Plc for the development of experimental cancer therapy Belrestotug.

The two companies were working together assessing the Belrestotug + Dostarlimab doublet in previously untreated, unresectable, locally advanced or metastatic PD-L1 high non-small cell lung cancer.

However, data from a Phase 2 study did not show improvements in progression-free survival with the combination compared to Dostarlimab monotherapy, and the companies subsequently decided to terminate the program and end the collaboration.

iTeos CEO Michel Detheux had said the company is “truly disappointed” by the trial results and is taking “immediate steps” to preserve capital.

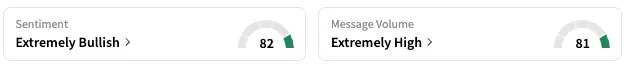

On Stocktwits, retail sentiment around ITOS jumped from ‘neutral’ to ‘extremely bullish’ territory over the past 24 hours while message volume rose from ‘normal’ to ‘extremely high’ levels.

A Stocktwits user expressed optimism about the company’s decision to halt operations.

ITOS stock is up approximately 29% this year but down by more than 40% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_1ebecab605.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_ATM_5257ead046.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_qatarenergy_jpg_907aa26daf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243817419_jpg_fd782b2997.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191224409_jpg_fd3e69e2d7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)