Advertisement|Remove ads.

JD.com Stock Listless Despite Q3 Profit Beat: Retail Is Doubling Down

Chinese e-commerce retailer JD.com, Inc. ($JD) reported Thursday ahead of the market open higher earnings and revenue for the September quarter.

Beijing-based JD.com’s quarterly non-GAAP earnings per share (EPS) came in at 8.68 yuan or $1.20, up 29.5% year-over-year (YoY). This exceeded the $1.06 per share consensus, according to Stocktwits data.

Net revenue rose 5.1% YoY to 260.4 billion yuan, missing the 261.45-billion-yuan LSEG consensus, according to Reuters.

The yuan to USD conversions are based on the current exchange rate.

The lackluster top-line performance reflected the domestic economy’s travails amid a struggling property market, moderating growth, and a deflationary environment.

The economy and geopolitical risks surrounding President-elect Donald Trump’s victory in the U.S. prompted the central bank and the government to announce copious stimulus measures.

JD.com is also left to contend with highly competitive industry dynamics.

Sandy Xu, CEO of JD.com, said, “We saw an uptick in our topline growth, as well as healthy profitability in the third quarter, as overall consumer sentiment continued to brighten.”

“Our general merchandise category also grew robustly in the quarter, driven by our efforts in driving better user experience and user mindshare, which were also highlighted by the enthusiastic user response to our Singles Day Grand Promotion this year.”

CFO Su Shan said the company’s efforts to build up supply chain capabilities in a bid to drive better scale benefits and operating efficiencies helped expand margins during the quarter.

As of 9 a.m. ET, JD.com shares fell 0.67% to $35.45.

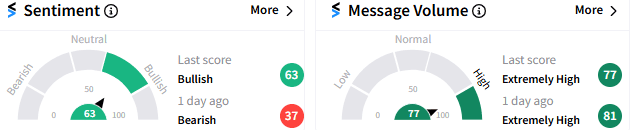

Retail sentiment on Stocktwits improved from ‘bearish’ (37/100) a day ago to ‘bullish’ (63/100), with message volume remaining ‘extremely high’.

A user on Stocktwits platform termed the quarter as “great” and hoped that Trump doesn’t crush China.

https://stocktwits.com/walter36/message/592517221

Another lauded the company’s cash position, profits, and efficiency as well as its attractive valuation.

The yuan trades at 7.24 versus a dollar.

Read Next: Cisco Stock Pulls Back Despite Q1 Beat, In-Line Guidance: Retail Stays Upbeat

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)