Advertisement|Remove ads.

Jefferies Downgrades Major US Airlines On Soft Consumer Sentiment Amid Swelling Macro Uncertainty — Retail’s Divided

Major airline stocks were in focus on Tuesday morning after Jefferies downgraded four prominent names, citing softer consumer sentiment this summer.

According to TheFly, Jefferies analyst Sheila Kahyaoglu downgraded Southwest Airlines Co. (LUV) to ‘Underperform’ from ‘Hold’ and reduced the price target to $28 from $30.

Jefferies expects March exit rates pressuring summer performance as corporate and consumer sentiment are anticipated to remain soft on "swelling macro uncertainty.”

Similarly, the firm downgraded Delta Air Lines Inc. (DAL) shares to ‘Hold' from ‘Buy' and slashed its price target to $46 from $85. Jefferies expects Southwest and Air Canada to cut their 2025 outlooks and believes Delta will likely do the same.

Meanwhile, American Airlines Group Inc. (AAL) stock was downgraded to ‘Hold’ from ‘Buy,’ and the price target was reduced to $12 from $20.

Earlier this month, top carriers revised their first quarter (Q1) revenue forecasts lower as concerns about a slowdown in the world’s largest economy gathered momentum.

Delta expects revenue growth of 3% to 4% in the first quarter of 2025 compared to its initial guidance of 7% to 9% growth. The airline has also lowered its operating margin forecast to 4% to 5% from the 6% to 8% projected earlier.

AAL had a similar story to tell. The airline expects its Q1 revenue to remain flat year-over-year (YoY) compared to an initial guidance of 3% to 5% growth. Losses are expected to widen to $0.60 to $0.80 per share compared to a previous forecast of a loss of $0.20 to $0.40.

Southwest Airlines also projected a lower revenue growth in Q1, but the airline’s decision to charge passengers to check bags pushed the stock higher.

Southwest expects 2% to 4% growth in its revenue available per seat mile (RASM) compared to its previous guidance of 5% to 7% growth.

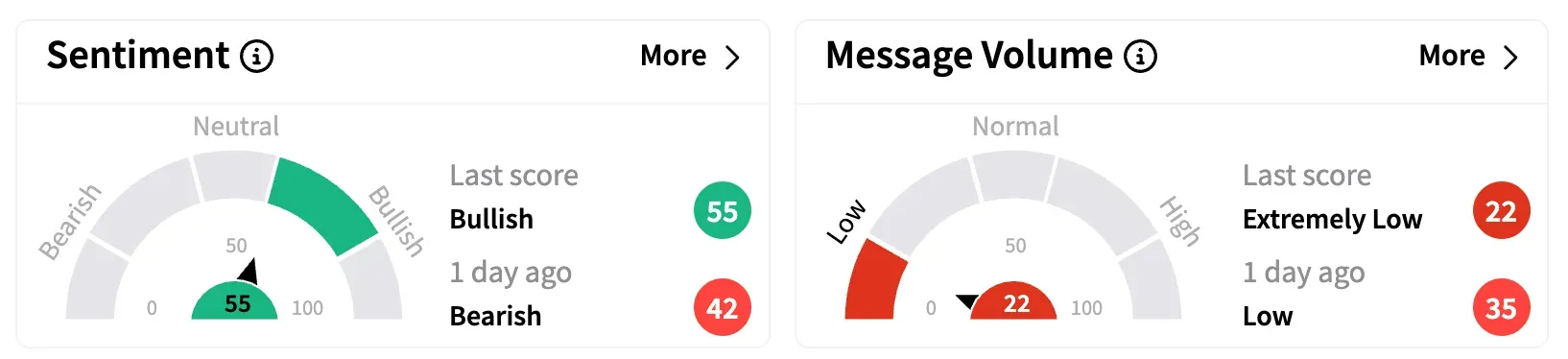

On Stocktwits, retail sentiment trended in the ‘bullish’ territory for AAL, DAL, and LUV stocks on Tuesday morning.

Amidst all the downgrades, Jefferies lowered United Airlines’ (UAL) price target to $80 from $154 but kept a ‘Buy’ rating on the shares. According to TheFly, United was the only ‘Buy’ rated stock in Jefferies' list of U.S. airlines.

However, on Stocktwits, retail sentiment trended in the ‘bearish’ territory for UAL, albeit with a higher score.

Airline stocks traded in the red in Tuesday’s pre-market session. Only Southwest Airlines' stock has recorded gains in 2025, with its shares gaining 0.63% year-to-date. AAL, DAL, and UAL shares have lost nearly 38%, 26%, and 27%, respectively, this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)