Advertisement|Remove ads.

Jensen Huang Reportedly Says Any Investor Aiming To Take A Stake In TSMC Is ‘Very Smart’ – Retail’s Excited

Taiwan Semiconductor Manufacturing Co. (TSM) reportedly received praise from Nvidia Corp.(NVDA) CEO Jensen Huang during the latter’s visit to Taiwan on Friday.

According to a CNBC report, Huang described any investor aiming to take a stake in the Taiwanese chipmaker as ‘very smart.’ He also emphasized TSMC’s critical role in Nvidia’s operations and global tech development, especially around its upcoming AI chip platform, Rubin.

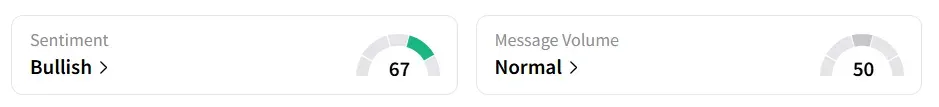

Taiwan Semiconductor stock inched 0.1% higher in Friday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘normal’ message volume levels.

A Stocktwits user wondered about the changes after Huang’s remarks.

Huang revealed that TSMC is currently developing six new products for Nvidia, according to the report. Among these are advanced CPUs (central processing units) and GPUs (graphics processing units), foundational technologies supporting AI applications.

The comments come amid speculation over U.S. interest in equity stakes within the global semiconductor sector. A Wall Street Journal report said internal discussions at TSMC indicated the company might return its $6.6 billion CHIPS Act subsidy for its Arizona-based fab if the U.S. seeks a stake in return.

The government has since clarified it doesn’t intend to seek equity from TSMC, citing its continued expansion of U.S. operations. The speculation rose after Commerce Secretary Howard Lutnick said the government is in talks to take a 10% stake in Intel and is open to pursuing similar deals elsewhere.

The contract chipmaker’s July revenue increased 22.5% year-on-year to NT$323.17 billion ($10.59 billion). Taiwan Semiconductor stock has gained over 15% year-to-date and over 36% in the last 12 months.

Exchange rate: 1 NT=0.03 USD

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)