Advertisement|Remove ads.

Jim Cramer Says The ‘Year of Magical Investing’ Is Ending – ‘Too Much OpenAI IOUs Flying Around’

- Former hedge fund manager and the host of Mad Money on CNBC said that markets are moving away from speculative AI investments and towards more profitable companies.

- His comments follow a pullback in large-cap technology names during the previous session.

- Nvidia and AMD stocks rebounded in pre-market trade on Wednesday after Foxconn reported strong earnings.

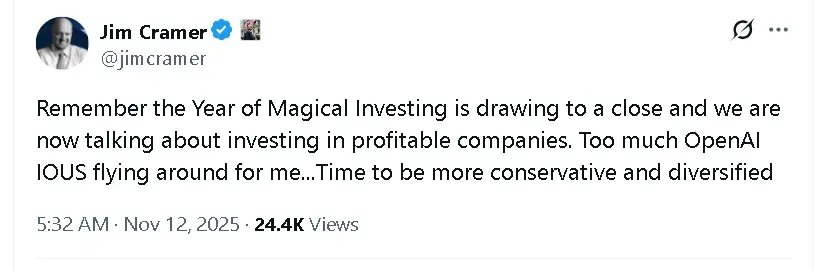

Jim Cramer said on Wednesday that the ‘Year of Magical Investing’ is coming to an end and that it's time for investors to pivot toward more conservative bets.

“Too much OpenAI IOUS flying around for me,” the Mad Money host and former hedge fund manager wrote in a post on X. “Time to be more conservative and diversified.”

The Year Of Magical Investing

According to Cramer, markets are shifting away from betting on future dreams toward focusing on fundamentals. His message implies an end to an era where investors put their money behind risky assets, especially those driven by themes like artificial intelligence (AI).

He also took a jab at OpenAI, implying that the hype around the AI startup has too many “future maybes” that he’s comfortable with. On Stocktwits, retail sentiment around OpenAI, which is not a publicly traded company, trended in 'bullish' territory over the past day. Cramer's comment adds to growing investor caution about whether AI-driven spending can translate into sustainable earnings growth.

Tech Stocks Show Signs Of Recovery

Cramer’s warning came as major equity benchmarks showed modest premarket gains on Wednesday following a pullback in large-cap technology names during the previous session. The SPDR S&P 500 ETF (SPY) was up 0.28%, the SPDR Dow Jones Industrial Average ETF (DIA) rose 0.17%, and the Nasdaq-100 tracking Invesco QQQ Trust (QQQ) moved 0.56% higher. Retail sentiment around QQQ on Stocktwits continued to trend in the ‘extremely bullish’ territory over the past day.

Chipmakers Nvidia (NVDA) and Advanced Micro Devices (AMD) also rebounded. Nvidia’s stock rose more than 1% after supplier Foxconn reported a 17% year-over-year increase in earnings, while AMD’s stock jumped over 5%. Retail sentiment around both Nvidia and AMD trended in ‘bullish’ territory over the past day.

Read also: Google Sues Global Cybercrime Ring Over Massive Smishing Campaign: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)