Advertisement|Remove ads.

Johnson & Johnson Stock Stumbles As Lowered Profit View Outweighs Q3 Earnings Beat: Retail Stays Optimistic

Johnson & Johnson’s (JNJ) third-quarter results on Tuesday left both Wall Street and retail investors satisfied, despite some lingering concerns that dragged the stock by 0.2% in early trading.

The company’s revenue rose 5.2% from a year earlier to $22.5 billion, beating analysts’ average expectations of $22.14 billion, while earnings per share of $2.42 blew past estimates of $0.30.

On the flip side, JNJ’s net income took a bigger hit than expected. Analysts had forecasted earnings to drop to $4.07 billion, but the company reported only $2.7 billion, marking a hefty 37% decline compared to last year.

Johnson & Johnson also revised its full year guidance to account for the acquisition of V-Wave, which is developing an implanted device for heart failure. It lowered its adjusted earnings guidance for 2024 to a range of $9.88 to $9.98 per share, down from the previous estimate of at least $9.97 per share.

“Costs associated with the acquisition of V-Wave more than offset the improvement,” the company stated in its earnings report.

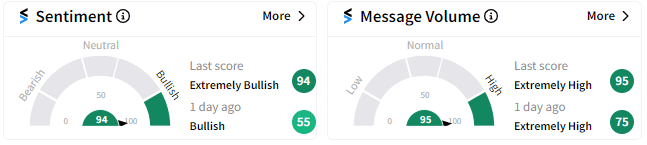

Retail sentiment on Stocktwits has improved to ‘extremely bullish’ (94/100) from ‘bullish’ a day ago.

JNJ reiterated its struggles to maintain growth with Stelara biosimilars already in the EU market, and expected to enter the US market in January. However, the company remains optimistic that its new approvals that expand the use of its cancer and immunology medicines will make up for it.

Johnson & Johnson’s stock has been relatively flat this year, up just 0.01% year-to-date and 1% over the past 12 months. However, in the last six months, it’s quietly mounted a 8% comeback,

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)