Advertisement|Remove ads.

JPMorgan Sees ‘Value Oriented Opportunity’ In Wendy’s Stock Despite Lowered 2025 Outlook — Retail Turns Cautious

JPMorgan upgraded Wendy's (WEN) stock to 'Outperform' from 'Neutral,' citing a stronger outlook for the fast-food chain's cash flow and long-term growth potential.

The current share price provides a "value-oriented opportunity," the investment firm said in a recent investor note, according to The Fly.

Wendy's stock is down 23.2% this year and currently trades around a five-year low.

Last week, the burger chain lowered its 2025 outlook. It now expects sales to be down 2% to flat, compared to its earlier forecast of 2% to 3% growth.

JPMorgan said it sees "significant upside" to Wendy's equity value from improved cash flow, better capital allocation, and potential for growth in some underpenetrated international markets.

The investment firm forecasts that Wendy's will generate approximately $605 million in free cash flow (FCF) from 2025 to 2028, with total shareholder returns potentially reaching $700 million through dividends and share buybacks.

JPMorgan lowered the price target on Wendy's shares to $15 from $17.

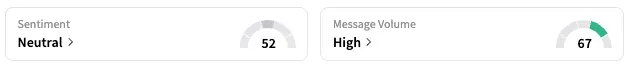

On Stocktwits, retail sentiment dropped to 'neutral' from 'bullish' a day earlier.

A user warned that the company could face dire consequences unless it cuts dividends.

Wendy's sales and profit for the first quarter also missed expectations.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_GE_Aerospace_resized_1_jpg_03f4fd7e4e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)