Advertisement|Remove ads.

JPMorgan Upgrades YOU Stock On Amex Renewal Optimism – How Far Is The New Price Target?

- JPMorgan has taken a more optimistic view of Clear Secure, citing that the business is positioned for stronger growth in 2026.

- One of the key reasons for JPMorgan’s more bullish stance centers on Clear’s long-running partnership with American Express.

- For the fourth quarter, Clear Secures sees revenue in the range of $234 million to $237 million.

Clear Secure Inc. (YOU) stock jumped nearly 12% and reached November 2024 highs on Friday after JPMorgan upgraded the stock to ‘Overweight’ from ‘Neutral’.

The firm also raised its price target on the shares to $42 from $35, according to TheFly. Following the jump in share price on Friday, the stock is barely $2 away from the new price target.

Potential Boost From Expiring Amex Agreement

Clear Secure, known for its airport identity-verification platform, has drawn high short interest compared to other companies in JPMorgan’s small-cap internet and gaming coverage universe.

The firm has taken a more optimistic view of Clear Secure, citing that the business is positioned for stronger growth in 2026. One of the key reasons for JPMorgan’s more bullish stance centers on Clear’s long-running partnership with American Express.

The two companies first teamed up in 2019. Under the deal, eligible American Express cardholders who sign up for Clear and use a qualifying Amex card to pay can receive up to $199 in statement credits each year toward their Clear Plus membership.

The five-year deal is set to conclude at the end of June, and JPMorgan expects renewal discussions to favor Clear. A revised arrangement could provide stronger economics and expand the reach of Clear’s membership programs.

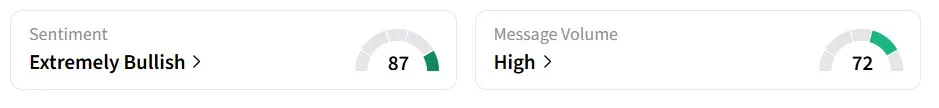

Meanwhile, on Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘high’ message volume levels.

Contract Expansion And Strong Financials

Recently, Clear Secure signed an agreement with the Centers for Medicare & Medicaid Services (CMS) to help upgrade how identities are verified for Medicare users and providers on Medicare.gov.

Starting in early 2026, Medicare.gov will use CLEAR’s identity tools to create accounts, recover login information, and access personal health data.

For the fourth quarter (Q4), the company expects revenue in the range of $234 million to $237 million versus the analysts’ estimate of $235 million, according to Fiscal AI data.

YOU stock has gained over 51% year-to-date.

Also See: Why Did Arcus Biosciences Stock Slump 10% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)