Advertisement|Remove ads.

JSW Steel Nears Breakout: SEBI RA Akhilesh Jat Eyes Bullish Move Above ₹1,045

JSW Steel has entered the analyst’s watchlist after showing signs of a potential breakout on the daily chart.

According to SEBI-registered analyst Akhilesh Jat, the stock has been forming a symmetrical triangle pattern, which typically signals a period of consolidation within a larger trend.

Given that the broader trend has been upward and the stock has respected a long-term rising trendline since early 2022, the setup appears structurally strong, Jat added.

As the triangle pattern nears its apex, the likelihood of a breakout increases. A decisive move above ₹1,045, backed by strong trading volumes, would confirm a bullish breakout and suggest a continuation of the prior uptrend, the analyst said.

In such a scenario, traders can consider initiating a positional buy above ₹1,045, with a stop loss at ₹980.

At the time of writing, JSW Steel shares were trading 0.3% higher at ₹1,027.35. The stock gained 4.13% over the past week.

The projected target for breakout is around ₹1,145, based on the height of the triangle. The setup offers a favorable risk-to-reward ratio, but it’s essential to wait for volume confirmation before entering the trade, Jat said.

JSW Steel has been in the spotlight lately. On Wednesday, the company filed a review petition in the Supreme Court challenging a verdict that nullified its resolution plan for Bhushan Steel and Power.

In 2021, JSW Steel acquired a 49% stake in Bhushan Power and Steel through the Insolvency and Bankruptcy process and increased its holding to 83% later that year.

However, the apex court later invalidated the resolution plan, citing the use of optionally convertible debentures instead of pure equity for the takeover and the failure to complete the resolution within the mandated timeframe.

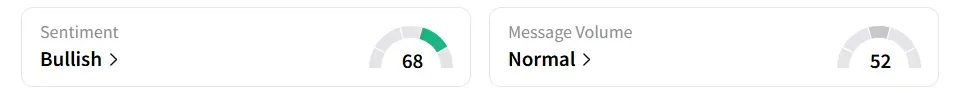

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier.

The stock has gained over 14% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)