Advertisement|Remove ads.

KKR To Acquire Additional 5% Stake In Italian Mobility Transformation Company Enilive: Retail’s On Wait-And-Watch Mode

Shares of KKR & Co Inc (KKR) traded nearly 1% higher in Tuesday’s pre-market session after the company announced it is set to acquire an additional 5% stake in Enilive from Eni for a consideration of €587.5 million ($614.75 million). The additional stake purchase will take KKR’s total holding in Enilive to 30%.

Enilive, Eni’s mobility transformation company, is involved in biorefining, biomethane production, smart mobility solutions, and providing services to support people on the move.

In October 2024, KKR announced it had acquired a 25% stake in Enilive through its Global Infrastructure Strategy. Established in 2008, the Global Infrastructure Strategy manages over $77 billion in infrastructure assets.

The transaction is expected to close by next month, and it is based on a post-money valuation of €11.75 billion ($12.29 billion) of equity value for 100% of Enilive's share capital.

The asset manager has been making investments in Italy since 2005. In July 2024, KKR announced the closing of its acquisition of Telecom Italia’s fixed-line network and incorporation into FiberCop. This created an extensive Italian broadband network that serves around 16 million households.

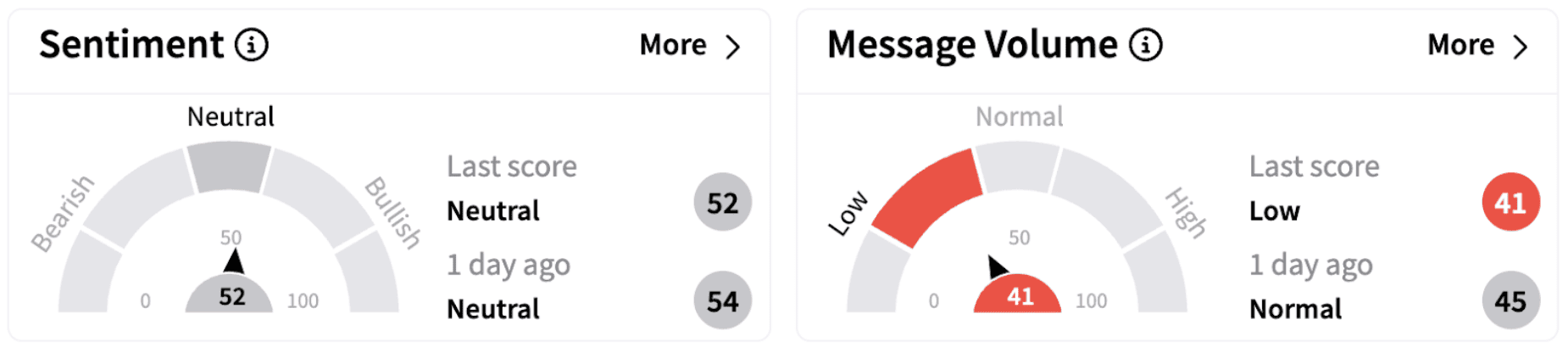

On Stocktwits, retail sentiment surrounding KKR continued to trend in the ‘neutral’ territory (52/100).

KKR was also in the news after Bain Capital said Monday that it had dropped its bid for Fuji Soft Inc., bringing an end to its battle with KKR for control of the company. Bain said it would not increase the purchase price of the target company’s shares in the tender offer (9,600 yen or approximately $63.28) and would not implement the tender offer.

KKR shares fell nearly 6% in 2025 but have risen nearly 51% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Exchange Rate:

1 Euro = $1.05

1 Yen = $0.0066

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_JPM_resized_jpg_5def7e91d0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)