Advertisement|Remove ads.

Howmet Aerospace Stock Hits Record High On Slew Of Price Target Hikes Post Upbeat Q4, Guidance: Retail Cheers The Move

Shares of Howmet Aerospace Inc (HWM) rose over 4% on Friday to hit record highs after the stock received a slew of price target hikes following its upbeat fourth-quarter earnings and positive outlook.

According to TheFly, Deutsche Bank raised the firm's price target on Howmet Aerospace to $155 from $135 while keeping a ‘Buy’ rating on the shares. Susquehanna raised its price target to $150 from $132 and kept a ‘Positive’ rating on the shares.

During the fourth quarter, revenue rose 9% year-over-year (YoY) to $1.9 billion

Howmet reported adjusted earnings per share (EPS) of $0.74 compared to a Wall Street estimate of $0.72. Net income rose 33% YoY to $314 million.

Segment-wise, Engine Products reported a 14% YoY rise in revenue to $972 million, while Fastening Systems’ revenue rose 11% to $401 million during the quarter.

Engineered Structures reported a 13% rise in revenue to $275 million, while Forged Wheels’ revenue declined 12% to $243 million.

In 2024, the company reduced gross debt by $365 million, resulting in annualized interest expense savings of approximately $37 million.

CEO John Plant said the outlook for commercial aerospace remains solid with rising original equipment manufacturer (OEM) production rates supported by strong demand and continued healthy growth in engine spares demand.

“We expect continued growth in the defense aerospace and industrial end markets, with the commercial transportation market anticipated to be soft until the second half of 2025,” he said.

The company expects first-quarter (Q1) revenue to be between $1.925 billion and $1.945 billion, compared to a Wall Street estimate of $1.917 billion. Adjusted EPS is expected to be between $0.75 and $0.77, versus an analyst estimate of $0.76.

Howmet guided full-year 2025 revenue at $7.93 billion to $8.13 billion compared to an analyst estimate of $8.09 billion. The company expects adjusted EPS at $3.13 to $3.21 versus a Street estimate of $3.25.

Truist analyst Michael Ciarmoli raised the firm's price target on Howmet Aerospace to $140 from $130 while keeping a ‘Buy’ rating on the shares. The brokerage noted that the company's FY25 guidance is ahead of the Street on revenue and earnings before interest, tax, depreciation, and amortization (EBITDA) but light on EPS and free cash flow.

JPMorgan also raised its price target on Howmet Aerospace to $130 from $125 while keeping an ‘Overweight’ rating on the shares.

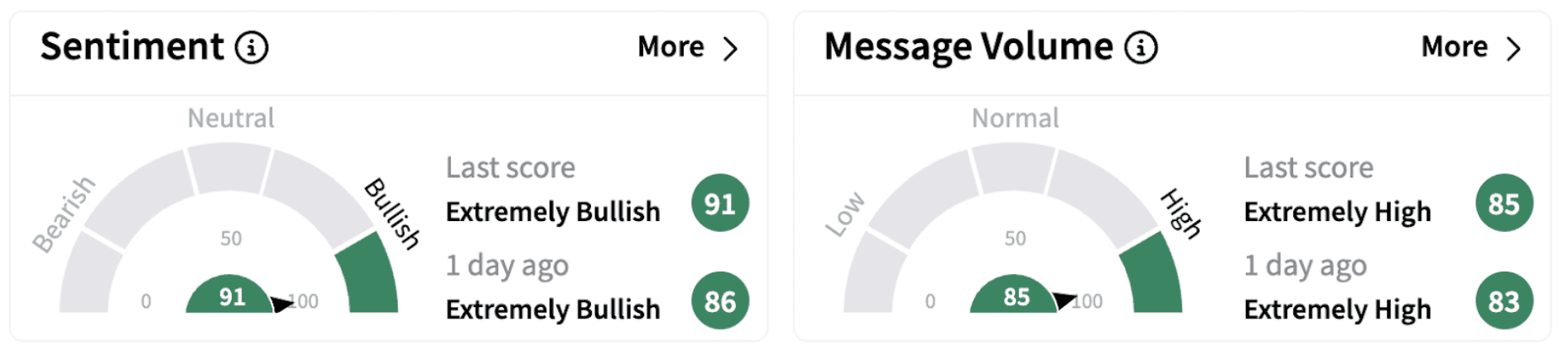

On Stocktwits, retail sentiment climbed further into the ‘extremely bullish’ territory (91/100) accompanied by significantly high retail chatter.

Howmet shares have gained over 20% in 2025 and have more than doubled in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2156649816_jpg_bde9d5ac58.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)