Advertisement|Remove ads.

Kohl’s Plans To Name Michael Bender Permanent Chief Exec After Cycling Through 3 CEOs In Four Years: Report

- Kohl’s could announce the appointment on Monday, a day before the company’s third-quarter report.

- The department store chain faces falling revenue and needs the CEO to offer long-term stability and direction.

- For Q3, analysts expect the company’s revenue to continue to decline with a negative bottom line.

Kohl's Corp’s shares will be in focus on Monday, after a report said the department store chain plans to make interim chief Michael Bender its permanent CEO.

The decision could be announced as early as Monday, Bloomberg reported on Sunday, citing a person familiar with the matter. The company is scheduled to report its third-quarter results on Tuesday before the markets open.

Three CEOs In Four Years

Bender was appointed the interim CEO in May after Kohl’s fired its then-CEO, Ashley Buchanan, for financial impropriety. Buchanan was found to have pushed for deals with a vendor with whom he had a personal relationship; he was in the CEO role for less than 100 days.

Kohl’s has cycled through three CEOs in the past four years, underscoring the company’s need for a leader who can provide long-term stability and direction. Bender, who was earlier the CEO at Eyemart Express and also worked at Walmart and Victoria’s Secret, joined Kohl’s board in 2019.

Retail’s View

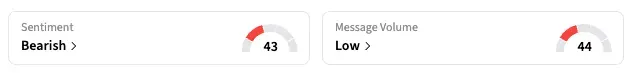

On Stocktwits, retail sentiment for KSS remained ‘bearish’ as of late Sunday, unchanged from last week, while message volume stayed ‘low.’

“At least we now know what we got, going forward. A proven record,” said a user.

“$KSS lets get this puppy trending again. Expecting lots more good news from Kohl's this week,” remarked another, a likely reference to expectations from the company’s upcoming earnings report.

Earnings Expectations

Analysts expect Kohl’s revenue to decline 4% to $3.39 billion, according to Koyfin. That would be the lowest pace of decline since the January 2024 quarter. Adjusted loss per share is expected to be $0.17, compared to a $0.20 per share adjusted profit in the year-ago quarter.

Kohl's results will likely show a sequential acceleration in sales trends, though it is expected to offer a cautious outlook, analysts at UBS said in an investor note earlier this month. Citi had opened an "upside 90-day catalyst watch" on the shares last month.

Kohl’s earnings come amid mixed results from major retailers: Walmart, thanks to its pole position, showed continued momentum, while Target’s sales shrank, prompting the company to cut its full-year profit forecast. Walmart, Target, and other consumer retail companies have flagged weak consumer spending among low-income consumers.

As of the last close, Kohl’s stock is up 11% year–to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)