Advertisement|Remove ads.

L&T Finance Surges Past Multi-Year Resistance: SEBI RA Priyank Sharma Eyes 90% Upside In The Next 15 Months

L&T Finance could see a 70% to 90% rally in the next 15 months, according to SEBI-registered analyst Priyank Sharma.

The stock has recently breached its multi-year key resistance zone to climb over a level last seen in October 2017, Sharma observed. Since then, L&T Finance stock has been consolidating above the breakout zone.

Such consolidation following a breakout often suggests underlying strength and presents a buying opportunity for the medium-term, the analyst said.

Since the start of 2025, the stock has surged more than 62% from its low, supported by strong buying momentum and improving market sentiment. The current price structure and sustained uptrend could whet investor appetite.

Sharma said the ideal accumulation zone is around ₹180, an opportunity to take up new positions.

At the time of writing, the shares were trading 0.4% lower at ₹205.37

He expects L&T Finance shares to hit ₹300 - ₹350 levels over the next 6 to 15 months, a 70% to 90% upside from the current trading price. He also cautioned against a stop-loss at ₹150, which would invalidate the bullish setup.

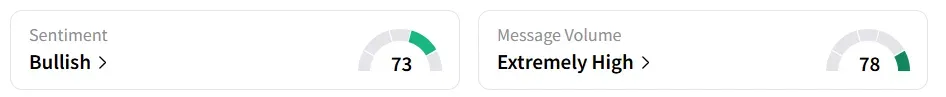

Retail sentiment on Stocktwits remained ‘bullish’ amid ‘extremely high’ message volumes.

The stock has gained nearly 50% year-to-date (YTD).

L&T Finance has been on the radar for multiple analysts on Stocktwits due to its strong bullish chart setup.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)