Advertisement|Remove ads.

LAKE Stock Tanked 40% Today To Hit 9-Year Lows – What Caused The Meltdown?

- The company also decided to suspend its quarterly cash dividend on common stock.

- Lakeland said its weak quarter was driven by broad macro pressures, including tariffs, freight and raw-material inflation.

- Q3 net sales of $47.6 million, fell significantly short of Street estimates of $56.7 million.

Shares of Lakeland Industries (LAKE) plunged 40% to their lowest level since July 2016 after a downbeat third-quarter report, prompting the company to withdraw both its FY26 guidance and dividend distribution.

Net sales for the third quarter of fiscal 2026 rose 4% to $47.6 million, up from $45.8 million a year earlier. However, it fell significantly short of Street estimates of $56.7 million. The company also posted a $16 million loss, compared with a $0.1 million profit last year. Organic gross margin decreased to 32.3% from 42.9%.

Withdrawing FY26 Guidance and Suspending Dividend

Lakeland said its weak quarter was driven by broad macro pressures, including tariffs, freight and raw-material inflation, that weighed on revenue and margins across the U.S., Canada, Latin America and parts of EMEA. At the same time, acquired businesses also underperformed due to certification delays and material-flow issues.

The company emphasized that these problems are fixable rather than demand-related, but the uncertainty has impaired its visibility, prompting Lakeland to withdraw its FY2026 guidance and halt future forecasts.

“We missed our targets across multiple areas. And as CEO, I take full responsibility for that performance. Our forecasting has not been reliable and the gap between our internal expectations and actual results has grown too large. Because of this, we will be withdrawing formal guidance,” said CEO Jim Jenkins, in a call with analysts.

J. Calven Swinea, Vice President of Finance at Lakeland, stated on the same call that given near-term headwinds and to manage cash prudently, the company has decided to suspend its quarterly cash dividend on common stock.

“We believe reinvesting profits into growth opportunities, such as acquisitions,” Swinea said.

How Did Stocktwits Users React?

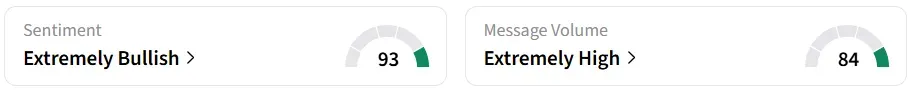

Despite the significant intraday decline, retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘bullish’ a day earlier, accompanied by ‘extremely high’ message volumes.

One user believes the drop may have been overdone.

Year-to-date, the stock has declined 65%.

Also Read: GEV Stock Soars To All-Time High As Wall Street Cheers Massive Upgrade And Rare Earth Stockpile Plan

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)