Advertisement|Remove ads.

Shipbuilding Stocks Rise After-Hours As Trump Reportedly Plans To Revive Industry: Retail Completely On Board

Shipbuilders’ stocks edged higher in after-hours trading on Tuesday after The Wall Street Journal reported that Donald Trump’s administration is preparing an executive order aimed at reviving U.S. shipbuilding and reducing China’s dominance of the global maritime industry.

The report, citing a draft summary reviewed by the Journal, noted that the order includes 18 initiatives, including generating revenue from fees on Chinese-built ships and cranes entering the U.S., and establishing a new office within the National Security Council to bolster the domestic maritime sector.

The report added that the measures also include lifting wages for nuclear-shipyard workers and asking Elon Musk’s Department of Government Efficiency to review government procurement processes, including the Navy’s.

However, the newspaper’s report said that the order is labeled as a draft and could change.

During an address to Congress on Tuesday, Trump said that the U.S. would move to resurrect the American shipbuilding industry, including commercial and military shipbuilding.

According to a report by the U.S. government, China’s market share of global ship production has grown steadily since the turn of the century, increasing from about 5% in 2000 to over 50%.

The Journal report said the draft executive order also includes measures to create maritime opportunity zones and a maritime security trust fund to boost investments.

Shipmakers Huntington Ingalls Industries (HII) and General Dynamics (GD) rose 2.3% and 0.6% after the bell.

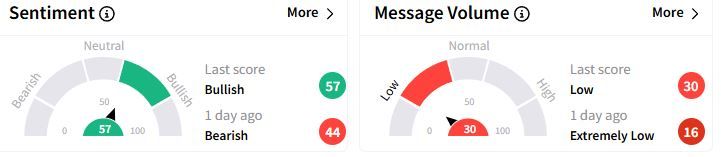

Retail sentiment about Huntington Ingalls on Stocktwits moved to ‘bullish’ (57/100) territory from ‘bearish’(44/100) a day ago, while retail chatter was ‘low.’

One user hoped to see a ‘Trump Bump’ for the stock while another regretted not buying the company’s shares.

Over the past year, Huntington Ingalls Industries shares have fallen 41.1% while General Dynamics shares have fallen 7.8%.

Also See: Phillips 66 Stock In Spotlight After Elliott Nominates 7 Directors, Retail Confidence Stays Low

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)