Advertisement|Remove ads.

Lawrence Summers Says US Looks Like A Developing Nation Where Stocks, Bonds, Currency Move Together: ‘That Has To Be Scary’

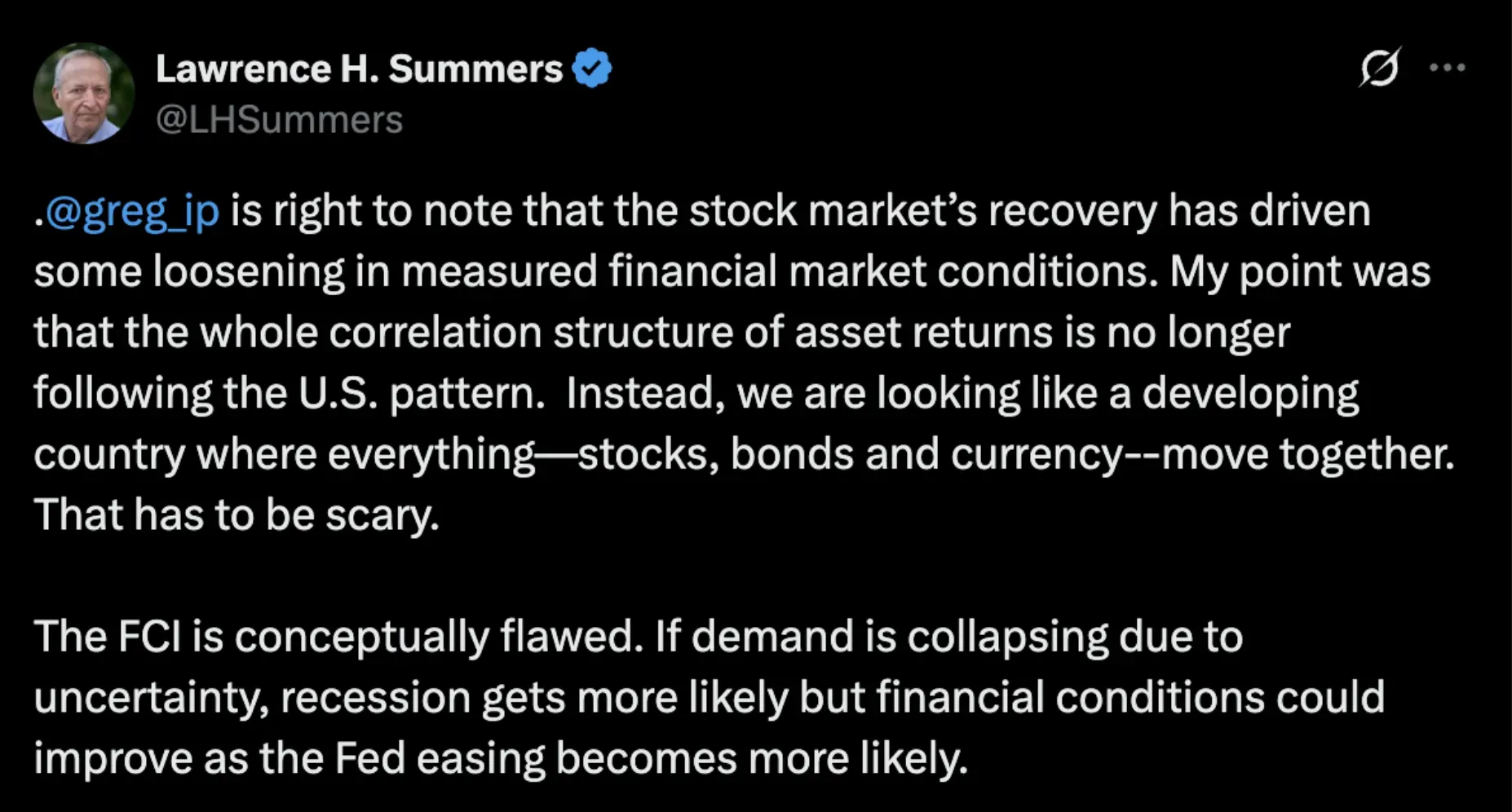

Former Treasury Secretary Lawrence Summers said the U.S. looks like a developing country where stocks, bonds, and currency move together.

“That has to be scary,” he said in his post on X.

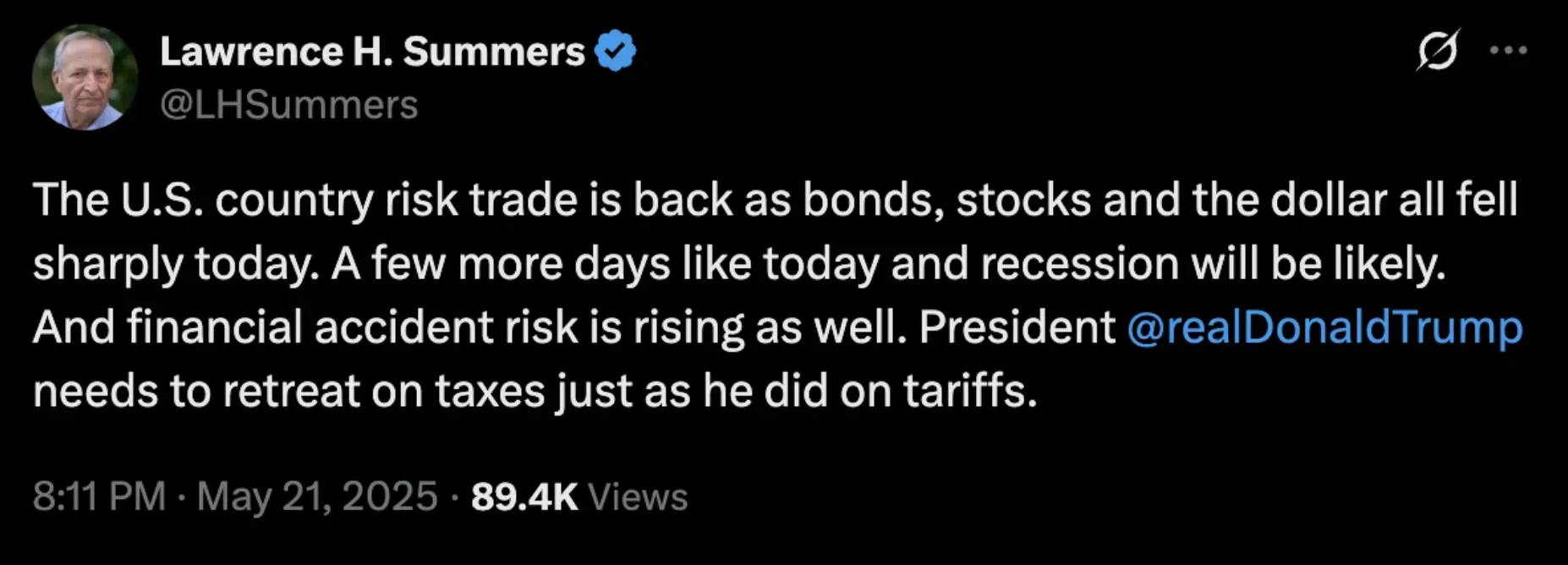

Summers earlier stated that the U.S. country risk trade is back as bonds, stocks, and the dollar all fell sharply.

“A few more days like today and recession will be likely. And financial accident risk is rising as well. President @realDonaldTrump needs to retreat on taxes just as he did on tariffs,” he said in an earlier X post.

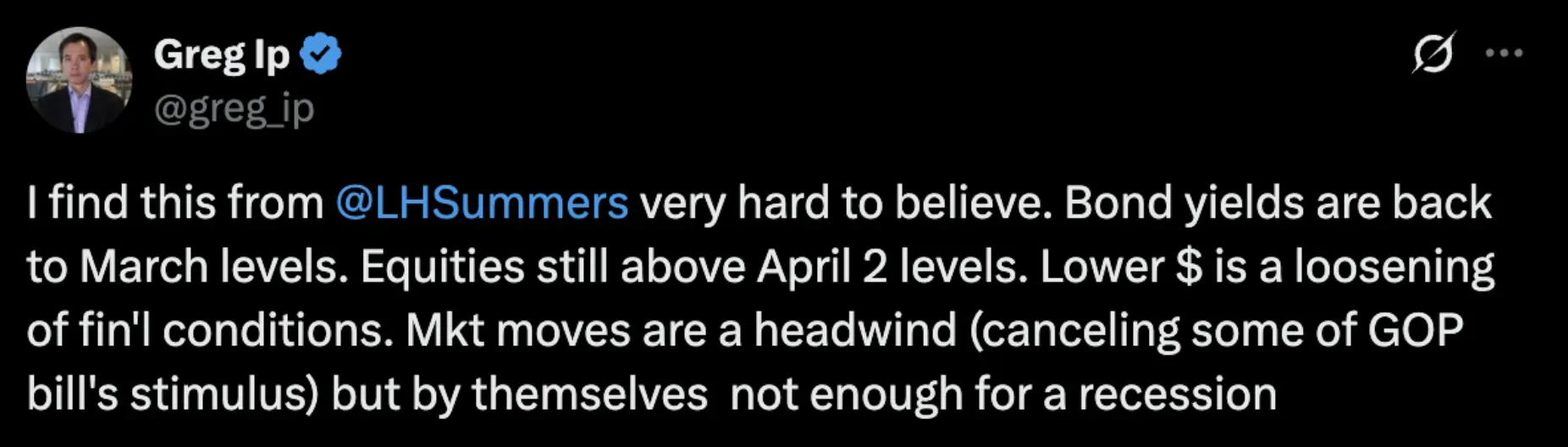

However, Greg Ip, The Wall Street Journal's chief economics commentator, countered that Summers’ view is hard to believe.

Ip noted that bond yields are back to March levels, equities are still above April 2 levels, and the lower dollar reflects a loosening of financial conditions. Although market moves are a headwind, he argued, they are not enough to cause a recession.

Summers then elaborated that the whole correlation structure of asset returns no longer follows the U.S. pattern and highlighted the concurrent moves across asset classes.

“If demand is collapsing due to uncertainty, recession gets more likely but financial conditions could improve as the Fed easing becomes more likely,” he said.

Notably, Atlanta Federal Reserve Chair Raphael Bostic recently said he prefers just a single rate cut this year as the central bank tries to balance the concerns surrounding the possibilities of a recession and upward inflation pressure.

“I am leaning much more into one cut this year, because I think it will take time, and then we’ll sort of have to see,” Bostic told CNBC.

Meanwhile, Trump’s tax bill was cleared in the House on Thursday morning and is now headed to the Senate.

The iShares 7-10 Year Treasury Bond ETF (IEF) traded 0.05% higher on Thursday morning.

Also See: Rio Tinto CEO Jakob Stausholm To Step Down Later This Year

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)