Advertisement|Remove ads.

Li Auto Stock Drops Pre-Market After EV Maker Lowers Q2 Delivery Outlook: Retail Remains Bullish

NASDAQ-listed Chinese EV maker Li Auto Inc. (LI) on Friday cut its second quarter delivery outlook to about 108,000 vehicles, sending shares of the company down 3% in the pre-market session.

The company had previously said that it expects to deliver between 123,000 and 128,000 vehicles in the second quarter (Q2).

Li Auto said that the outlook revision was made to reflect the temporary impact of the company’s sales system upgrade. The EV maker expressed confidence in completing its organizational upgrade before the launch of its Li i8 battery electric SUV, which is expected in late July.

Li Auto had started volume production in November 2019. Its current model lineup includes Li MEGA, a high-tech flagship family MPV, Li L9, a six-seat flagship family SUV, Li L8, a six-seat premium family SUV, Li L7, a five-seat flagship family SUV, and Li L6, a five-seat premium family SUV.

As of the end of May, Li Auto has delivered a cumulative 1,301,531 vehicles.

In April and May, the company delivered 33,939 and 40,856 vehicles, respectively. As per the company’s latest delivery outlook, it expects to deliver around 33,205 vehicles in June.

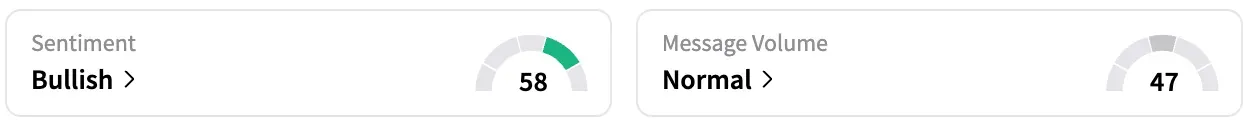

On Stocktwits, retail sentiment around Li Auto stayed unchanged within ‘bullish’ territory over the past 24 hours while message volume remained within ‘normal’ levels.

According to data from Koyfin, 22 of 28 analysts covering Li Auto rate it a ‘Buy’ or higher, while six rate it a ‘Hold’. There are no ‘Sell’ ratings on the stock.

The average price target on the stock is $33.53. This represents a near 20% upside to the stock’s closing price on Thursday.

LI stock is up by about 17% this year and by about 53% over the past 12 months.

Read Next: Blackstone Doubles Down, Snaps Up $2B in Commercial Real‑Estate Loans: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es6_jpg_b768981c5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228901180_jpg_0c2cc7dc28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1232171389_jpg_55d81c88fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)