Advertisement|Remove ads.

Liberty Energy Slips After Wells Fargo Downgrades On Weaker Oil Prices, Retail’s Bullish But Slightly Less Optimistic

Liberty Energy (LBRT) stock fell 4.7% on Tuesday after Wells Fargo downgraded the firm to ‘equal weight’ from ‘overweight.’

The brokerage also trimmed the price target for the stock to $11 from $20. The new price target still implied a 4.9% upside compared to Monday’s close.

The stock has a consensus price target of $19.71, according to FinChat data.

The brokerage noted that the risk of oil prices continuing to decline following the OPEC+ production increase is real.

Last week, eight member countries of the oil producer group agreed to boost output by 411,000 barrels per day in May, compared to a 135,000 bpd hike expected earlier.

The brokerage noted that risks versus reward, the lower 48 U.S. states versus international positioning, and present valuation favor large-cap oilfield services firms.

Wells Fargo analysts said decreases in exploration and production spending intensity amid continued efficiency improvements will likely weigh on pricing power for fracking and other services.

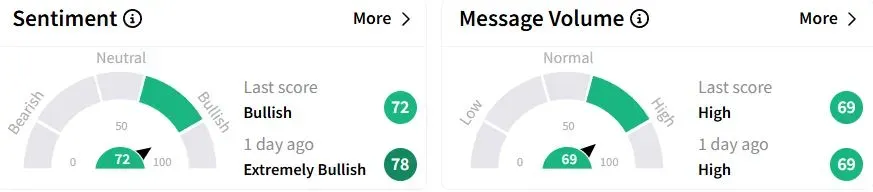

Retail sentiment on Stocktwits moved to ‘bullish’ (72/100) from ‘extremely bullish’(78/100) a day ago, while retail chatter was ‘high.’

Liberty shares have fallen 50.7% year-to-date (YTD) amid a downturn in the North American oilfield services business. Producers have kept a tight lid on spending amid volatile commodity prices.

Concerns around a recession have also battered oil prices after President Trump introduced 10% tariffs on all imports, with some countries facing even higher tariffs.

The company is scheduled to report its first quarter earnings after the market closes on April 16.

Also See: Trump Tariffs – White House Remains Defiant, Says 104% Levies On China To Kick In From Midnight

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Netflix_jpg_ed6fa4554b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Broadcom_jpg_f302b01f15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)