Advertisement|Remove ads.

Lithium Americas Stock Soars 17% After JV Announcement With General Motors: Retail Cheers The Deal

NYSE-listed shares of Lithium Americas ($LAC) soared over 17% on Wednesday after the firm announced it will establish a joint venture (JV) with General Motors (GM) for funding, developing, constructing and operating Thacker Pass in Humboldt County, Nevada.

Lithium Americas intends to develop Thacker Pass to become one of North America's largest sources of lithium chemicals.

Under the terms of the agreement, GM will acquire a 38% asset-level ownership stake in Thacker Pass by contributing $625 million of cash and letters of credit alongside the conditional commitment for a $2.3 billion U.S. Department of Energy (DOE) loan announced earlier this year.

The letters of credit include $430 million of direct cash funding to the JV to support the construction of Phase 1 and a $195 million letter of credit facility that can be used as collateral to support reserve account requirements under the DOE Loan.

Lithium Americas said this is the largest ever publicly announced investment by a U.S. original equipment manufacturer (OEM) in a lithium carbonate project.

The transaction builds on GM’s February 2023 Tranche 1 investment of $320 million, following which it acquired approximately 15 million common shares of Lithium Americas.

Meanwhile, Lithium Americas will contribute $387 million of funding to the JV for its 62% ownership. Of this, $211 million will be contributed on the date of the JV closing while the remainder will be contributed upon final investment decision (FID) for Phase 1.

Lithium Americas and GM intend to make the FID and issue full notice to proceed for Thacker Pass by the end of the year, after closing the DOE Loan and the JV transaction.

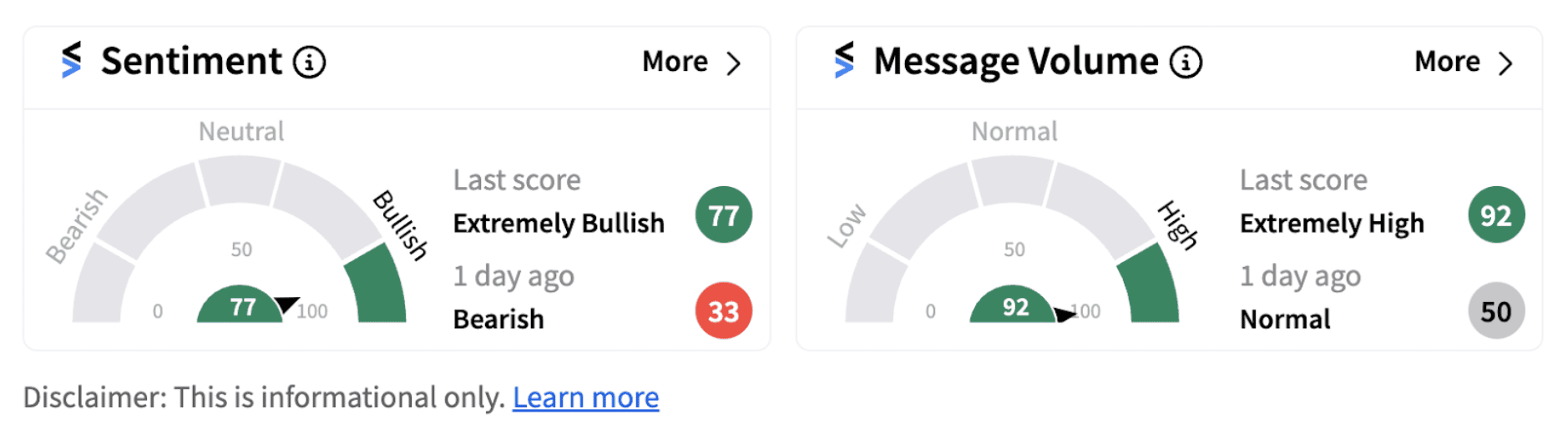

Following the announcement, Stocktwits retail sentiment for Lithium Americas jumped into the ‘extremely bullish’ territory (77/100), accompanied by ‘extremely high’ retail chatter.

However, despite the surge in the stock price on Wednesday, Lithium Americas shares are down over 50% on a year-to-date basis.

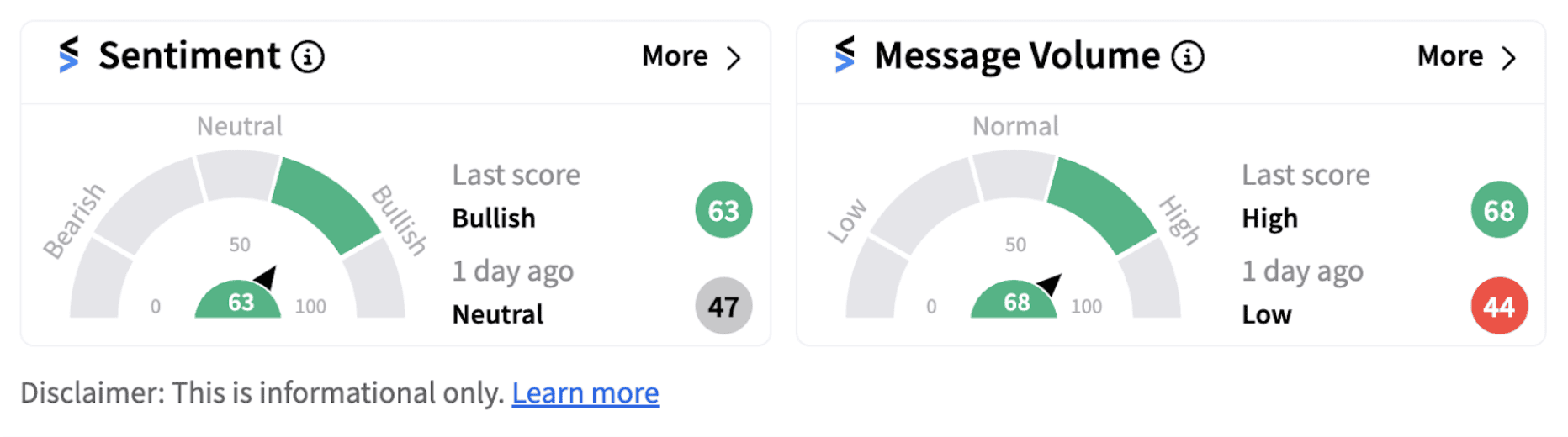

Meanwhile, General Motors, too, witnessed a spike in sentiment.

On a year-to-date basis, the stock has gained over 35%, thereby, significantly outperforming the benchmark indices.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)