Advertisement|Remove ads.

Morgan Stanley Q3 Report Surpasses Wall Street Estimates: Retail’s Turned Cautious After Stock Near Record Highs

Morgan Stanley (MS) on Wednesday reported better-than-expected third-quarter results driven by its wealth management division. Shares of the lender were trading over 3% higher in Wednesday’s pre-market session.

The bank posted a 16% year-over-year (YoY) rise in its Q3 revenue to $15.38 billion, compared to a Wall Street estimate of $14.41 billion. Earnings per share (EPS) came in at $1.88 versus a projected $1.58. Net income jumped 32% YoY to $3.19 billion.

Net interest income (NII), the difference between interest earned and interest expended, fell 9% YoY to $1.77 billion, primarily due to lower average sweep deposits and partially offset by higher yields on the investment portfolio and lending growth.

Notably, provision for credit losses decreased 41% YoY to $79 million, due to lower provisions in the commercial real estate sector compared to the prior year quarter.

The bank’s wealth management revenue rose 14% YoY to $7.27 billion during the quarter, reflecting strong asset management and transactional revenues. The bank said the business added net new assets of $64 billion in Q3 and total client assets reached $6 trillion.

Meanwhile, investment banking revenue shot up 56% YoY to $1.46 billion — a trend that aligns with most big bank earnings this quarter.

CEO Ted Pick said the firm reported a strong third quarter in a constructive environment across its global footprint.

“Institutional Securities saw momentum in the markets and underwriting businesses on solid client engagement. Total client assets have surpassed $7.5 trillion across Wealth and Investment Management supported by buoyant equity markets and net asset inflows,” he noted.

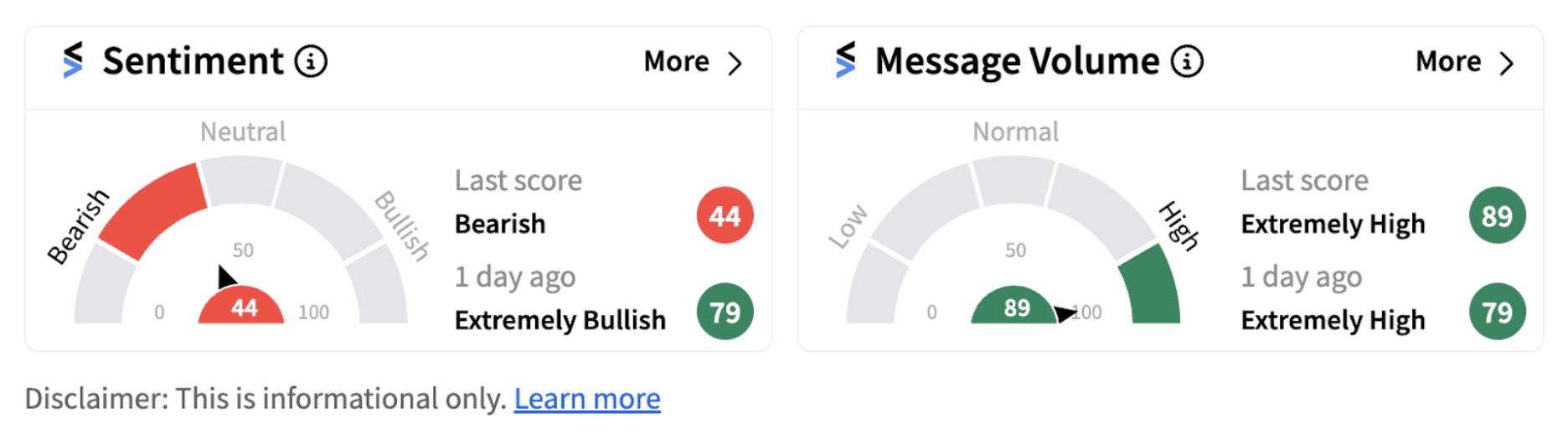

Despite the upbeat results, retail sentiment on Stocktwits flipped into the ‘bearish’ territory (44/100) from ‘extremely bullish’ a day ago, accompanied by extremely high retail chatter.

Shares of the lender have gained over 19% on a year-to-date basis and are on their track to hit record highs.

Also See: United Airlines Delivers Upbeat Q3, Unveils First Post-Pandemic Share Buyback: Retail’s Exuberant

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)