Advertisement|Remove ads.

Lloyds Engineering, Prestige Estates, Swan Energy Could Rally On Breakout: SEBI RA Rajneesh Sharma

SEBI-registered analyst Rajneesh Sharma flagged a bullish outlook for Swan Energy, Prestige Estates, and Lloyds Engineering Works, citing favorable technical indicators.

Lloyds Engineering Works

Sharma observed that the stock is currently forming a symmetrical triangle on the weekly chart, with the price approaching key breakout levels.

The stock has strong support in the ₹58 - ₹60 zone and faces resistance around ₹75 - ₹76. A recent spike in volumes during an uptrend signals renewed buying interest, while the formation of higher lows suggests steady accumulation.

A breakout above ₹76, accompanied by strong volume, could confirm a bullish trend. However, until that happens, the stock may continue to consolidate within the ₹60 - ₹76 range.

At the time of writing, the stock was up 4.1% to ₹74.07, having shed 3.4% year-to-date (YTD)

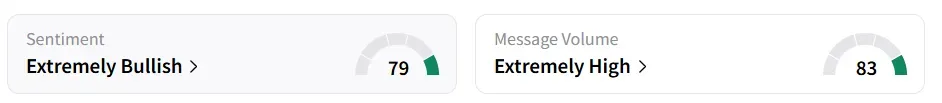

Retail sentiment on Stocktwits was ‘extremely bullish’, accompanied by ‘extremely high’ message volumes.

Prestige Estates

Prestige Estates has broken out above the key ₹1,529 resistance level on the weekly chart and is now consolidating above it, Sharma said.

Momentum indicators are turning positive, with the weekly relative strength index (RSI) climbing above neutral and volume increasing on up-days.

The next major target is its all-time high of ₹1,898, while support remains at ₹1,529. Sharma cautions a stop-loss on a weekly close below ₹1,500.

Overall, it’s a good stock to hold or accumulate on dips within the ₹1,550 - ₹1,600 range for a potential move toward ₹1,900, he added.

At the time of writing, the stock was down 1.3% to ₹1,638. It declined 3.6% YTD.

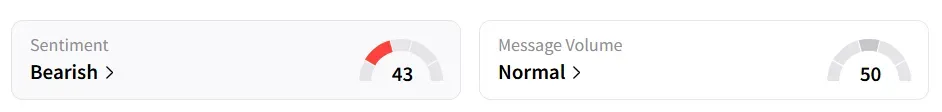

Retail sentiment on Stocktwits remained ‘bearish’.

Swan Energy

The stock is currently trading sideways but showing signs of exhaustion near its recent lows, with support in the ₹400 - ₹410 range and resistance around ₹488 - ₹490, Sharma observed.

On the weekly chart, a potential base formation is emerging, supported by an OBV (On-Balance Volume) divergence, which suggests underlying accumulation. Volume trends also indicate that selling pressure may be cooling.

The price is consolidating just below a key supply zone, making the ₹490 level critical for a breakout. A decisive move above this resistance could trigger a rally toward ₹600 or higher. However, if the stock fails to hold above ₹400, the bullish setup would be invalidated, he added.

At the time of writing, Swan Energy stock was down 0.5% at ₹443.

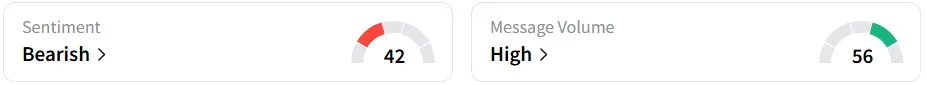

Retail sentiment on Stocktwits turned ‘bearish’ from ‘neutral’ a day ago, amid ‘high’ message volumes.

YTD, the stock has lost 38.5% of its value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)