Advertisement|Remove ads.

Lockheed Martin Extends Maturity Date Of Credit Agreement, Provides Updates On F-35 Technology Refresh 3

Lockheed Martin said in an SEC filing that on Aug. 23, it entered into an amendment with its creditors to extend the maturity date of the credit agreement by one year (from Aug. 24, 2028 to Aug. 24, 2029) and to remove the existing financial maintenance covenant that required the company to comply with a maximum leverage ratio of 65%.

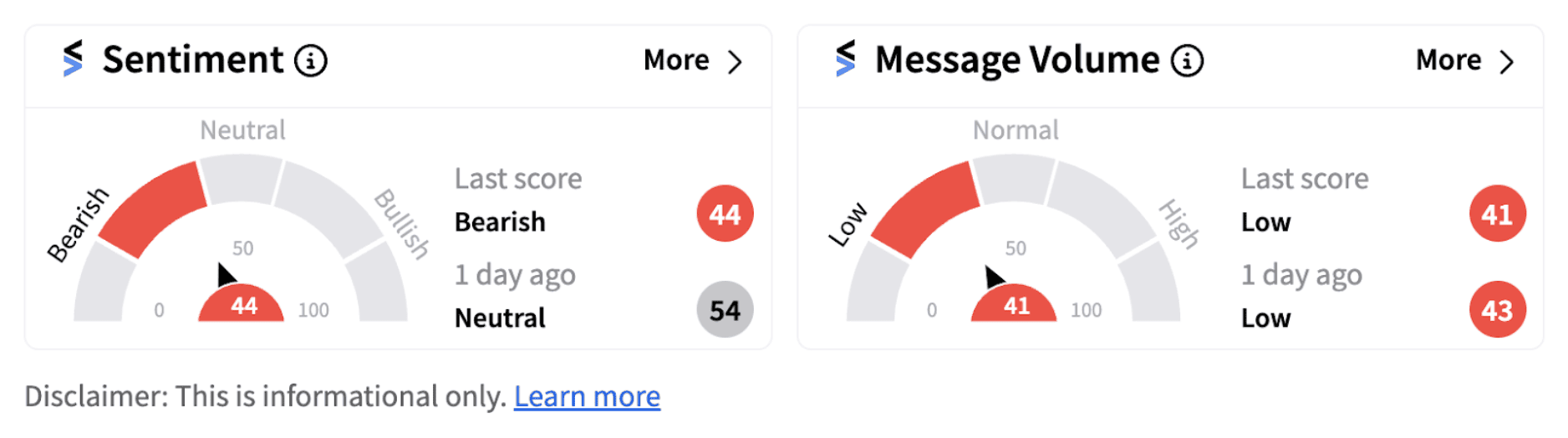

Retail sentiment on Stocktwits dipped into the ‘bearish’ territory (44/100) from the ‘neutral’ zone following the disclosure.

Meanwhile, the company also provided an update regarding its F-35 Technology Refresh 3. Lockheed said it has reached an agreement with the U.S. government’s F-35 Joint Program Office (JPO) for the acceptance and delivery of Technology Refresh 3 enabled aircraft with robust combat training capability.

The JPO will withhold a portion of final aircraft delivery payments from the company until TR-3 combat capability is qualified and delivered, it said. Lockheed is also making significant investments in development labs and digital infrastructure that benefit the F-35 enterprise’s speed and agility in fielding capabilities, it said.

Recently, the company announced it will acquire spacecraft manufacturer Terran Orbital at an enterprise value of $450 million. Lockheed Martin said it will acquire the firm for $0.25 in cash for each outstanding share of common stock and retire its existing debt. The transaction also provides for Lockheed Martin and other current Terran Orbital creditors while establishing a $30 million working capital facility in place.

The deal is expected to close in the fourth quarter of 2024. Interestingly, Lockheed has been Terran Orbital's largest customer. Terran Orbital was listed in March 2022 through a special purpose acquisition company.

Lockheed Martin shares have had a decent run this year with year-to-date gains of over 23%. The stock is currently trading at a reasonable price-to-earnings (PE) ratio of 20.25 despite the rally this year.

Also See: Vale Stock Rises As Gustavo Pimenta Named Next CEO After Rigorous Selection, Retail Applauds

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)