Advertisement|Remove ads.

Vale Stock Rises As Gustavo Pimenta Named Next CEO After Rigorous Selection, Retail Applauds

Shares of Brazilian mining and logistics operator Vale S.A. rose over 2% on Tuesday after the company announced Gustavo Pimenta as its next CEO.

Vale said the executive was unanimously elected by the firm’s board of directors, after a rigorous selection process supported by an international headhunting company.

Pimenta has over 20 years of experience in the financial, energy and mining sectors, in Brazil, the United States and Europe. In 2021, he assumed the position of executive vice-president of Finance and Investor Relations at Vale S.A. According to a Bloomberg report, Pimento beat out 14 other external candidates to win the leadership position at the Rio de Janeiro-based firm.

He will be replacing current CEO Eduardo Bartolomeo who reportedly played a crucial role in restoring the firm’s reputation after Brazil’s worst mining disaster in January 2019.

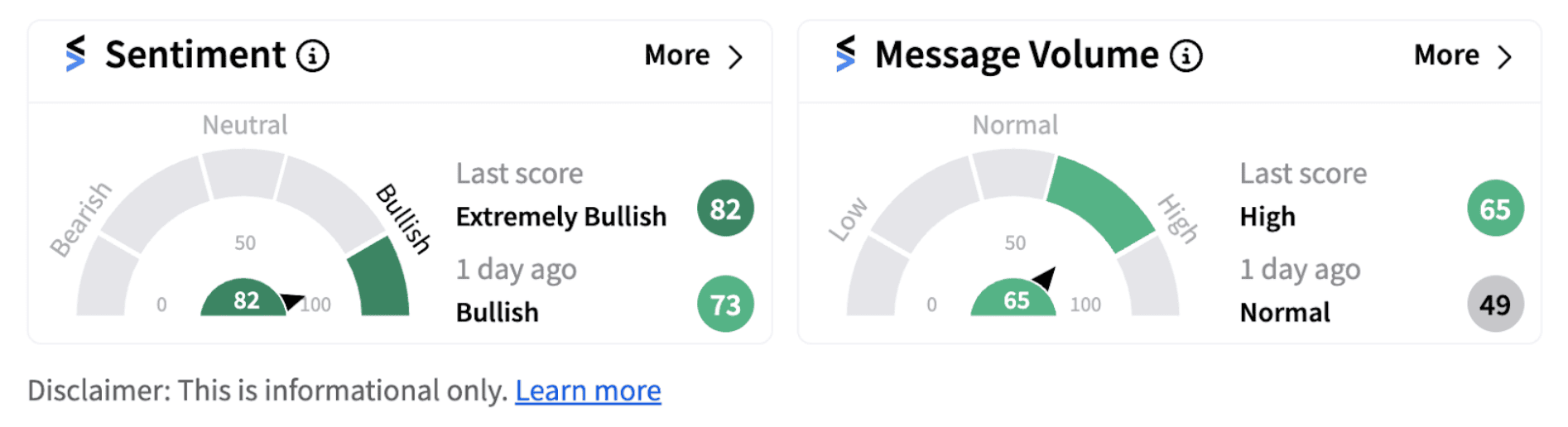

Following the announcement, retail sentiment on Stocktwits entered the ‘extremely bullish’ territory (82/100) from the ‘bullish’ zone, accompanied by high message volume.

The Bloomberg report further added that the firm’s succession plans were mired in government interference attempts, information leaks and quarrels among board members. The report stated that Bartolomeo wanted to retain his position but couldn’t garner enough support.

Meanwhile, the company reported a strong set of second-quarter results recently. Net operating revenues rose 3% year-over-year (YoY) to $9.92 billion while net income attributable to Vale shareholders soared 210% YoY to $2.77 billion.

The firm’s iron ore shipments increased by 5.4 Mt (up 7% YoY), driven by record production. Bartolomeo stated that as part of the firm’s strategic objective to become the supplier of choice for low-carbon steel, it is advancing on key growth projects such as Vargem Grande and Capanema, which together will add 30 Mt of capacity in the next twelve months.

Stocktwits users are expressing optimism over the leadership transition. One user named ‘TheFrack’ hoping the stock will move up from the current levels.

Also See: SMCI Stock Dips After Hindenburg Research Discloses Short Position: Retail Sentiment Plummets

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)