Advertisement|Remove ads.

Long-Term Value Bet: Sagility India Eyes Breakout Above ₹43, SEBI RA Krishna Pathak Recommends Buy On Dips

Sagility India shares are displaying a stable technical structure, signaling strong potential for long-term gains.

Sagility stock is near its 9-week exponential moving average (EMA), indicating underlying strength, while technical charts show a healthy consolidation pattern, said SEBI-registered analyst Krishna Pathak.

It has been consolidating within a range, with support at ₹33 and resistance around ₹43. The ₹37 - ₹40 zone appears to be an attractive accumulation range, backed by historical buying interest, Pathak said.

While the Stochastic Relative Strength Index (RSI) suggests the stock is slightly overbought, it may lead to a brief pause or minor pullback before the next leg up. A decisive breakout above ₹43 may open the door for targets of ₹48, ₹53, and ₹57 over the long term.

However, a sustained drop below ₹33 would be a sign of weakness and may invalidate the current bullish setup, the analyst added.

For long-term investors, a staggered entry strategy near ₹37 - ₹40 could be worthwhile, with ₹33 serving as the critical risk level. As long as the stock holds above this support, the broader structure remains constructive.

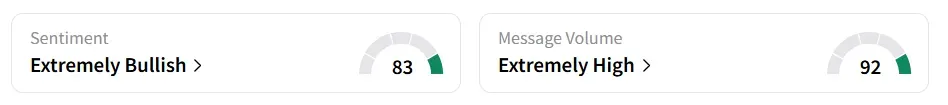

Retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘neutral’ a day earlier, amid ‘extremely high’ message volumes.

At the time of writing, the shares were trading 0.17% lower at ₹42.31 on Friday.

Earlier this year, the stock came under heavy selling pressure on reports that a promoter was looking to offload a 15% stake via an offer for sale. Shares were locked in the lower circuit limit.

The stock has shed nearly 12% year-to-date (YTD) but could finally be seeing an extended uptrend.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)