Advertisement|Remove ads.

LTIMindtree Faces Near-term Weakness Despite Q1 Profit Growth: SEBI RA Harika Enjamuri Flags Breakdown Risk

IT services company LTIMindtree reported favourable June quarter (Q1FY26) results, broadly in line with street estimates.

However, sentiment on Dalal Street remained subdued, with LTIMindtree stock down 1.2% at ₹5,108, mirroring the broader weakness in the Nifty IT index, which slipped 0.7% on Friday.

Consolidated net profit grew 11% year-on-year (YoY) to ₹1,255 crore, with revenue rising 8% to ₹9,841 crore. On a sequential basis, profit after tax grew 11.2% from ₹1,129 crore in Q4FY25, while revenue saw a marginal uptick of 0.7% from ₹9,772 crore.

So far, earnings from the technology sector have failed to enthuse investors, with major IT companies, including Tata Consultancy Services (TCS), HCL Technologies, and Tech Mahindra, reporting weak Q1 earnings.

According to SEBI-registered analyst Harika Enjamuri, LTIMindtree is showing signs of short-term consolidation on the charts, with the stock bouncing from its resistance zone between ₹5,400 and ₹5,500.

It is currently trading below its 9-day exponential moving average (EMA) of ₹5,278 and is approaching the 70-day EMA at ₹4,984, Enjamuri noted. The daily relative strength index (RSI) stands at 44.7, indicating weakening momentum without entering oversold territory.

On the weekly chart, the stock is struggling to hold above its 100-week EMA of ₹5,412, suggesting medium-term resistance, she said. The stock could fall to ₹4,880 or even ₹4,670 if it breaches the crucial range between ₹5,080 and ₹5,100.

Conversely, a breakout above ₹5,400 on strong volume could trigger a rally toward ₹5,725 and ₹5,860.

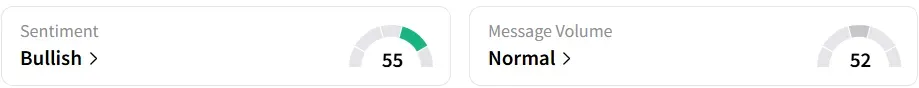

Despite the share price decline on Friday, retail sentiment on Stoktwits was ‘bullish’.

Year-to-date losses stand at 9%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)