Advertisement|Remove ads.

Lululemon’s Stretch Is Snapping: Market Share Losses, Executive Turmoil And An Identity Crisis Are Testing Investors’ Patience

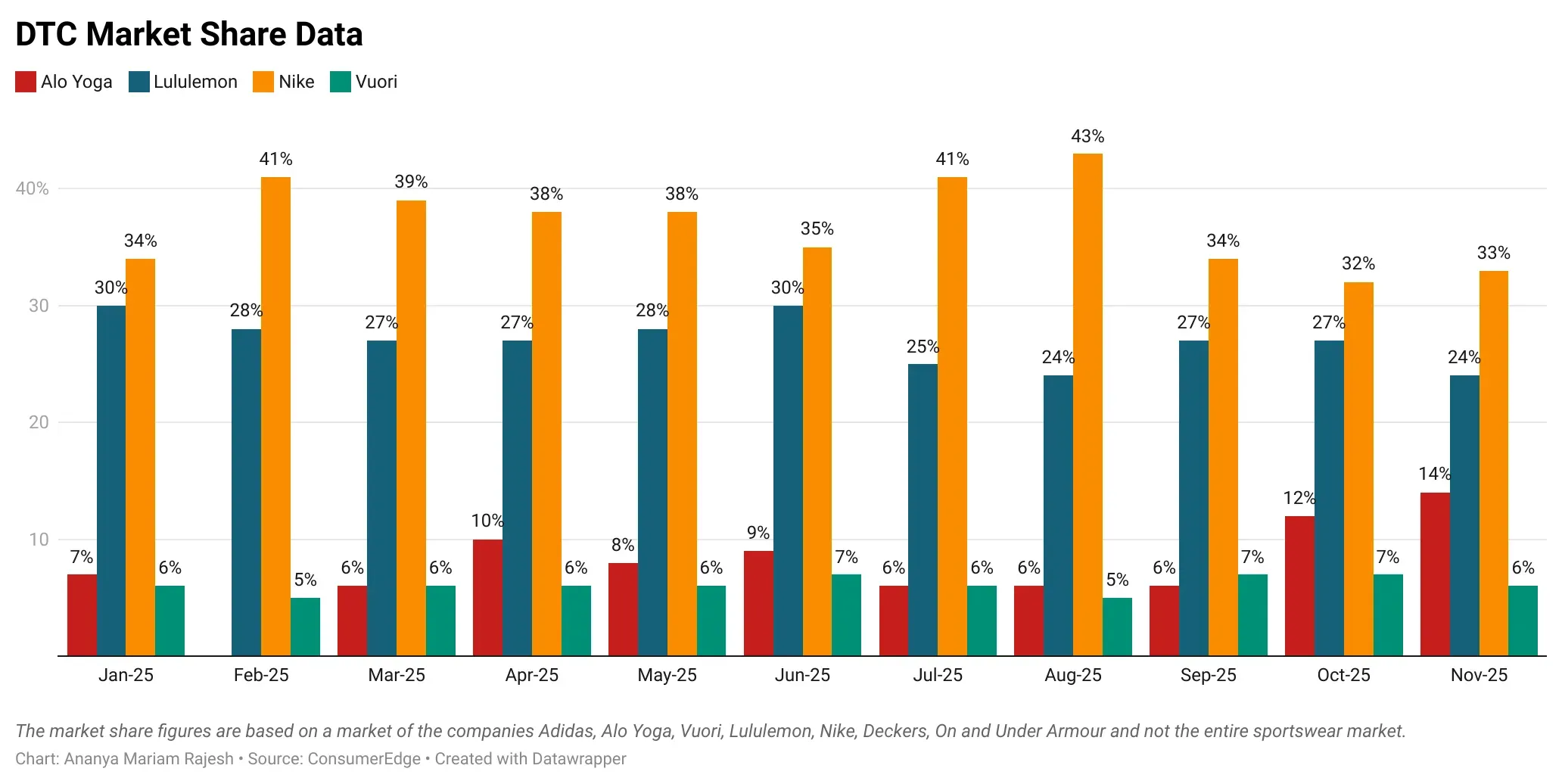

- According to data from ConsumerEdge, Lululemon Athletica’s direct-to-consumer channel market share has significantly softened since the start of the year. At the same time, Alo Yoga has gained market share.

- CEO Calvin McDonald in September, acknowledged that the company let its product life cycles run too long within many of the core categories, particularly in lounge and social.

- Needham analyst Tom Nikic believes Lululemon's turnaround will be more difficult with the departure of Celeste Burgoyne, the company's President of the Americas.

Lululemon’s yoga-pants swagger is noticeably shaken ahead of another keenly watched earnings. Once the undisputed darling of the athleisure boom, especially during COVID-19 lockdowns and peak work-from-home routines, the brand is now fighting to win back shoppers and outpace a crowd of hungry competitors. But the comeback is taking longer than Wall Street expected.

Product misfires, rising tariffs, and a muddier macroeconomic backdrop have knocked Lululemon off its stride, and the company has indeed acknowledged the stumbles. The big question is whether it can still flex and stretch like it used to.

According to data from Consumer Edge shared with Stocktwits, Lululemon Athletica’s direct-to-consumer channel market share has significantly softened since the start of the year. At the same time, Alo Yoga has gained market share.

LULU stock has lost more than 50% of its value and has traded well below Nike’s shares in 2025.

DTC Market Share

In January 2025, Lululemon held a 30% market share in the direct-to-consumer channel, compared with Nike, Adidas, On, Alo Yoga, Vuori, Under Armour, and Deckers, according to Consumer Edge. By November, that had dropped to 24%, a sharp decline from the 27% seen in September and October. However, Alo Yoga’s market share rose to 14% in November, compared to 12% in October and 8% in September.

Vuori's market share, meanwhile, has remained consistent throughout the year, at 5% in November, while Under Armour and On Holdings have also seen their market shares remain more or less the same.

Lululemon’s New Path: Add More Newness

In September, CEO Calvin McDonald acknowledged that the company let its product life cycles run too long in many core categories, particularly in lounge and social. “We've become too predictable within our casual offerings and missed opportunities to create new trends,” he said. “Our lounge and social product offerings have become stale and have not been resonating with guests.”

Dana Telsey of Telsey Advisory Group, however, noted that newness was increased with new styles and seasonal colors in core styles, but the customer has not reacted as anticipated.

The company now expects to increase the percentage of new styles in its overall assortment from the current 23% to approximately 35% by next spring. Telsey said Lululemon expects a meaningful impact from its product initiatives beginning in 2026.

A Double Whammy In America

It is not just a product innovation that is on the minds of executives; it is the higher costs from tariffs and a generally cautious consumer in the United States. McDonald in September said that the overall market for premium athletic wear in the U.S. remains challenging, with declines continuing.

“Consumers are spending less on apparel overall, spending less in performance activewear, and are being more selective in their purchases, seeking out truly new styles,” he said.

The company has been seeing tariffs take a bigger chunk of its margins and is also seeing an impact from the ending of the ‘de minimis’ exemption, which allowed tariff-free imports under $800.

Exec Exodus Is Worrying Wall Street

Needham analyst Tom Nikic believes Lululemon's turnaround will be more difficult with the departure of Celeste Burgoyne, the company's President of the Americas. This is Lululemon's second high-profile executive departure in the last 18 months, following the exit of Chief Product Officer Sun Choe in 2024, Nikic said.

Lululemon said that, given Burgoyne’s departure, it has decided to consolidate regional leadership across the company. The company named Andre Maestrini as President and Chief Commercial Officer, Jefferies analyst Randal Konik said the firm sees this leadership change as a negative.

Konik noted that North America is a mature and challenging market with recent declines in demand trends and Maestrini, based in London, lacks strong North American experience, which "raises doubts whether he's the right pick.”

How Are Retail Users Reacting?

Retail sentiment for Lululemon on Stocktwits has slipped to ‘bullish’ from ‘extremely bullish’ a year ago, when Trump’s tariffs were not on anyone’s bingo cards. Message volumes, meanwhile, have jumped by 46% and followers have increased by 20% over the same period, indicating robust interest from retail traders in the stock.

Shares of Lululemon have lost half of their value so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamie_dimon_jpmorgan_jpg_cbdd07fa63.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_So_Fi_new_6d7889a863.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_4_jpg_bb96bc484b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)