Advertisement|Remove ads.

Lupin Shares: SEBI RA Deepak Pal Sees Upside To ₹2,030

Lupin’s shares are displaying a bullish trend backed by a strong technical structure, while the company’s fundamentals reinforce a promising long-term outlook.

According to the weekly chart, Lupin’s stock is currently consolidating between its 14-day and 55-day exponential moving averages (EMAs), suggesting underlying bullish strength despite a brief pause in momentum, according to SEBI-registered analyst Deepak Pal.

This price action last week indicated sustained investor interest, Pal noted. Momentum indicators such as the moving average convergence/divergence (MACD) and relative strength index (RSI) are gradually strengthening, the analyst said.

In the near term, the stock could encounter minor resistance around the ₹2,000 mark. However, any dip toward ₹1,950 could be viewed as a buying opportunity, with a stop-loss at the same level to manage risk, he added.

On the upside, Lupin is well-positioned to test levels of ₹2,025 - ₹2,030 in the upcoming sessions.

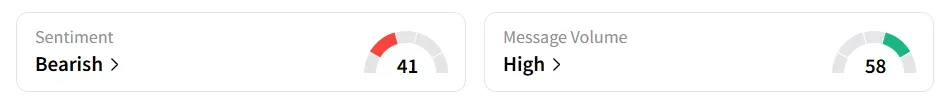

On Stocktwits, retail sentiment remained ‘bearish’ amid ‘high’ message volumes.

At the time of writing, Lupin’s shares were trading 2.70% lower at ₹1,922.10. Year-to-date (YTD), the stock has shed over 18%.

Lupin reported a net profit of ₹1,936 crore in FY24, a turnaround from a loss of ₹1,510 crore in the previous year. The company continues to invest significantly in R&D, with over 440 patents and 506 approvals in complex generics and biosimilars.

Lupin maintains a healthy balance sheet, strong cash flows, and appears well-positioned for long-term growth. Although it is trading at a premium valuation, the analyst added.

Investors in pharmaceutical companies like Lupin will be closely monitoring the US-India trade deal announcement that is expected soon.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)