Advertisement|Remove ads.

Lyft Stock Drives Higher On Report Of Mobileye-Powered Robotaxi Rollout In Dallas By 2026: Retail Enthusiasm Flies High

Shares of ride-hailing service provider Lyft Inc (LYFT) traded nearly 4% higher on Monday afternoon after a TechCrunch report indicated that the company intends to launch fully autonomous Mobileye-powered robotaxis as soon as 2026.

The report further said that Japanese conglomerate Marubeni will own and finance the Mobileye-equipped vehicles that will reflect on Lyft’s ride-hailing app.

A Lyft spokesperson told Barron’s that the rollout will begin in Dallas “with plans to scale thousands of vehicles to additional cities.”

Lyft CEO David Risher posted on X that Marubeni is a major global player in fleet ownership, managing over 900,000 vehicles through various subsidiaries and joint ventures. He noted that the company has seen year-over-year growth in its B2B/B2C (business-to-business/business-to-consumer) auto financing business.

“They're aiming to be leaders in the emerging AV (autonomous vehicles) space, and we look forward to working together,” Risher said.

Lyft’s executive vice president of driver experience, Jeremy Bird, told TechCrunch that the plan involves scaling to thousands of vehicles across multiple cities following the Texas debut.

“Mobileye’s got the technology and the relationship with the OEMs (original equipment manufacturers), and we have the platform, so it’s the ownership of the fleet that’s the big missing piece,” Bird told TechCrunch. “And when you have somebody that has experience in [fleet management] and the resources and the willingness to be a first-mover, that changes the game for us.”

Lyft is scheduled to report earnings after the bell on Tuesday. According to FinChat, Wall Street expects the firm to report earnings per share (EPS) of $0.23 on revenue of $1.54 billion.

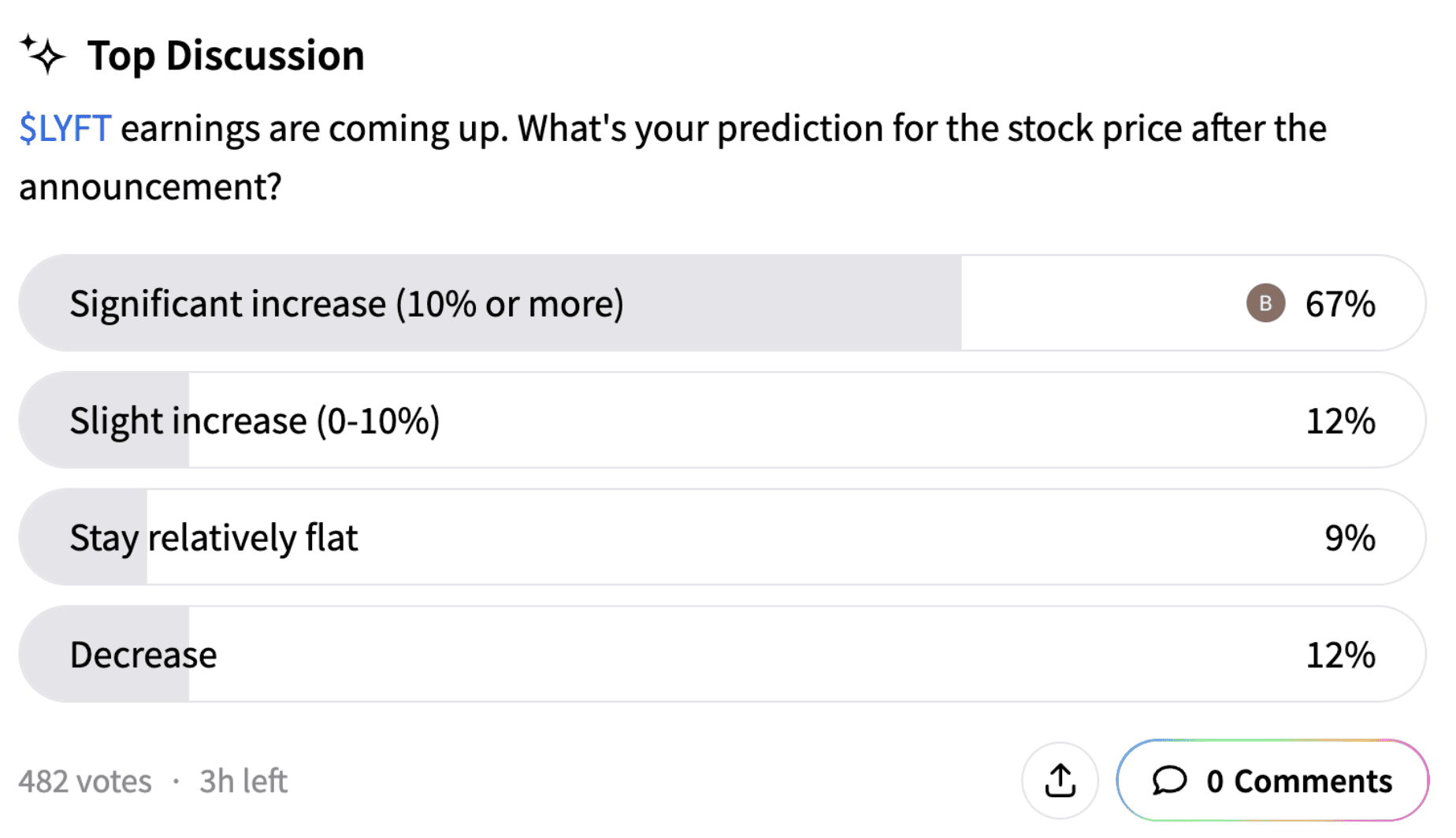

According to a Stocktwits poll, 67% of the respondents believe the stock will rally 10% or more following the earnings report. Twelve percent believe the shares will witness a slight increase, while another 12% believe the stock will fall. Only 9% believe the stock will remain flat following the results.

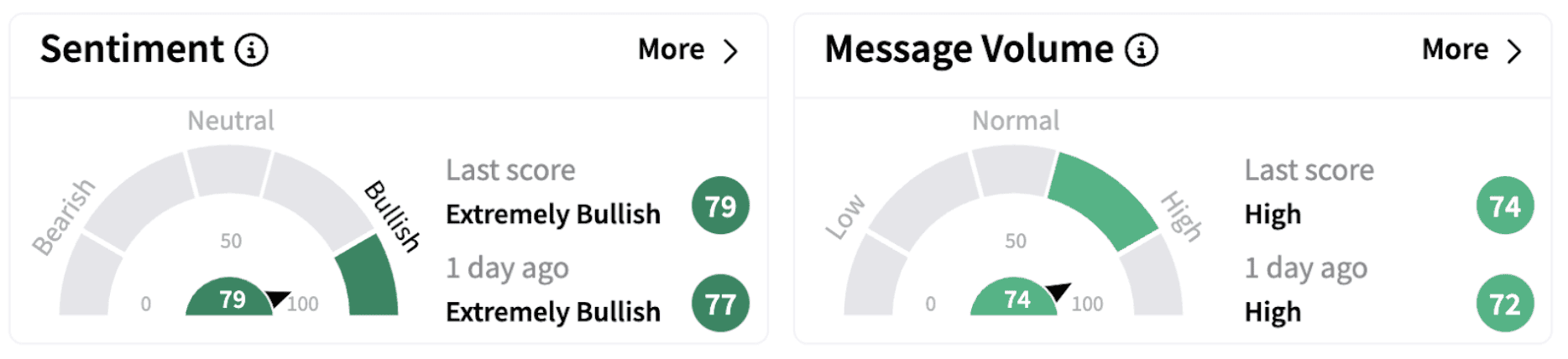

Meanwhile, retail sentiment surrounding the stock climbed further into the ‘extremely bullish’ territory (79/100), accompanied by ‘high’ message volume.

Lyft shares have gained over 7% in 2025 and have risen over 18% in the past year.

Also See: Morgan Stanley Expects January Core CPI To Accelerate 0.37% Over Wildfires, Seasonality Issues

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)