Advertisement|Remove ads.

Manyavar Operator Vedant Fashions Charts Signal Potential Turnaround: SEBI RA Rajneesh Sharma Flags Key Levels To Watch

Vedant Fashions, which operates the popular ethnic wear brand Manyavar, may finally be showing signs of a reversal after months of sustained selling pressure.

The stock fell steeply from around ₹1,550 to a low of ₹790, forming a classic downtrend marked by lower highs and lower lows, said SEBI-registered analyst Rajneesh Sharma. However, recent price action suggests that this bearish momentum may be waning.

At the time of writing, Vedant Fashions’ stock was trading at ₹818.4.

One of the key signals of trend exhaustion is the stock’s repeated bounce from the ₹790 - ₹800 support zone, with the price forming higher lows, indicating reduced selling pressure, Sharma noted. The On-Balance Volume (OBV) has been rising even as prices fell, signaling possible accumulation.

Key price levels to monitor include the ₹790 - ₹800 support, which remains critical for reversal, while a decisive break below the ₹709 level could weaken the bullish outlook, Sharma added.

On the upside, a breakout above ₹888 - ₹900 could confirm the strength and open the path toward ₹1,044 and possibly ₹1,199, where resistance may be encountered, he said.

Supporting the bullish prospects, momentum indicators such as the Average Directional Index (ADX) are strengthening, while the +DI (positive directional indicator) has crossed above the -DI. Recent bullish candles have been backed by rising volumes, signaling growing buying interest, the analyst said.

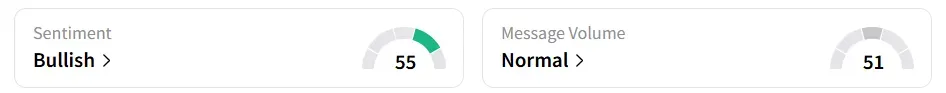

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier.

Year-to-date (YTD), the stock has shed 35.89%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)