Advertisement|Remove ads.

Marvell Crashes After Q4 Earnings, Price Target Cuts — But One Firm Sees a Buying Opportunity As Retail Optimism Hits Year-High

Marvell Technologies (MRVL) shares tumbled as much as 19% in pre-market trading Thursday after multiple Wall Street firms cut their price targets, citing concerns over the company's growth trajectory.

However, Loop Capital took the opposite stance, upgrading the stock to ‘Buy’ from ‘Hold,’ aligning with bullish sentiment among retail investors on Stocktwits.

The brokerage set a $110 price target, implying more than 20% upside from Marvell’s Wednesday close of $90.14, according to TheFly.

Marvell reported fourth-quarter (Q4) earnings per share (EPS) of $0.60, narrowly topping estimates of $0.59.

Revenue came in at $1.82 billion, slightly ahead of the expected $1.80 billion.

Despite the modest beat, investors reacted negatively to the company’s forward guidance, leading to the sharp sell-off.

For Q1, Marvell guided to an EPS between $0.56 and $0.66 and revenue of $1.875 billion, plus or minus 5%.

However, Loop Capital analyst Kevin Mobley argued that the post-earnings plunge presents an attractive entry point for investors.

“Following strong Q4 results and above-consensus guidance for Q1, we see the nearly 40% correction in shares since January as an opportunity,” Mobley wrote in a note to investors.

He acknowledged that Marvell’s results fell short of the market’s high expectations but noted that AI and cloud growth remain key drivers.

“Based on the sell-off in shares in the aftermarket, clearly investors didn’t get the numbers they needed to sustain MRVL’s rich valuation,” he said. “However, we believe the risk-reward profile has now become compelling.”

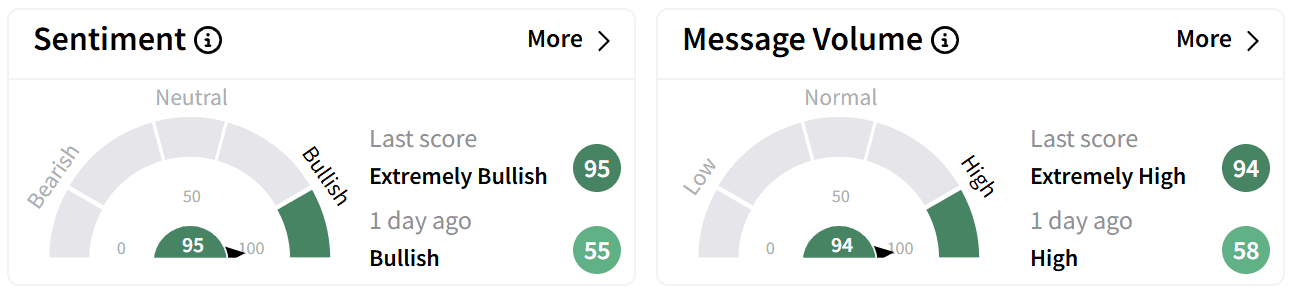

On Stocktwits, retail sentiment around Marvell’s stock surged to a year-high in the ‘extremely bullish’ (95/100) zone, with message volume skyrocketing over 2,100% in the past 24 hours.

While Wall Street took a cautious stance, retail traders on Stocktwits viewed the dip as a buying opportunity.

Marvell shares have declined 18% year-to-date but remain up 15% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)