Advertisement|Remove ads.

Mastercard Stock Draws Retail Buzz After Q1 Beat, CEO Says No Major ‘Upfronting Of Spending’ Yet

Mastercard (MA) stock drew retail attention on Thursday after the payments firm’s quarterly earnings topped Wall Street’s estimates.

On an adjusted basis, the company reported earnings of $3.73 per share for the three months ended March 31, compared with analysts’ expectations of $3.56 per share, according to FinChat data.

The Purchase, New York-based company's quarterly revenue of $7.25 billion also beat Wall Street’s estimates of $7.12 billion.

The company reported a net income of $3.28 billion, or $3.59 per share, for the first quarter, compared with $3.01 billion, or $3.22 per share.

As of March 31, 2025, the company’s customers had issued 3.5 billion Mastercard and Maestro-branded cards.

The company’s payment network net revenue rose 13%. Its gross dollar volume, which implies the total value of transactions processed, rose 9% to $2.4 trillion.

“Consumer and business sentiment has weakened primarily due to concerns surrounding the impact from tariffs and geopolitical tensions,” CEO Michael Miebach said in a call with analysts.

While there have been concerns that first-quarter payment volumes might be affected by customers moving up their purchases to avoid tariffs, Mastercard said it hadn’t seen such a trend emerge.

“In our data, we don't really see significant upfronting of spending,” Miebach said.

Morningstar analysts noted that tariffs create significant near-term uncertainty but it will take time for the impact to be felt.

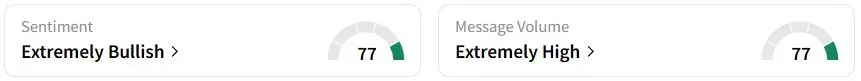

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (77/100) territory, while retail chatter was ‘extremely high.’

One retail trader said that the stock was inflation-proof, while another user said that tariffs might not affect Mastercard.

Mastercard stock has risen 3.3% year to date (YTD).

Also See: EOG Resources Tops Q1 Profit Estimates, Trims 2025 Capex On Tariff Uncertainty: Retail’s Divided

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)