Advertisement|Remove ads.

Five Shipping Stocks To Watch In 2025: SEBI RA Equitymaster Research Sees Potential Amid Global Volatility

With rising geopolitical tensions in the Middle East and increasing volatility in global shipping rates, India’s shipping sector is back in the spotlight.

SEBI-registered analyst Equitymaster Research picks five key shipbuilding stocks to keep an eye on:

Mazagon Dock Shipbuilders

Mazagon Dock stands out as the only Indian shipyard capable of building destroyers and conventional submarines.

With an order book of ₹380 billion for FY25 and a capital expenditure plan of ₹50 billion over the next four to five years, the company is positioning itself for long-term growth. It is also targeting a profit-before-tax (PBT) margin of 12–15%.

At the time of writing, the stock is down 0.3% at 3,164.10, having gained nearly 42% year-to-date (YTD).

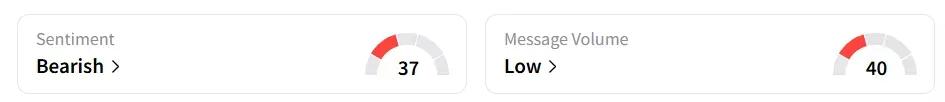

Retail sentiment on Stocktwits remained ‘bearish’.

Cochin Shipyard

Cochin Shipyard made headlines by building INS Vikrant, India’s first indigenous aircraft carrier. Its order book stands at ₹225 billion, with around 70% tied to defence contracts.

The company is also expanding into green shipbuilding, ship repairs, and renewable energy segments—aligning with India's broader push for sustainability and self-reliance in defence.

Cochin Shipyard stock was down 1% at ₹2,114.90. Year-to-date (YTD), the shares have gained 38%.

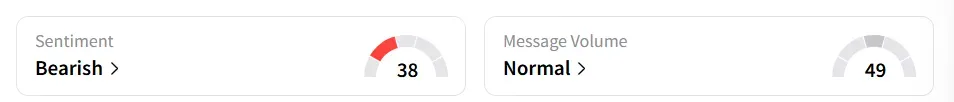

Retail sentiment on Stocktwits remained ‘bearish’.

Garden Reach Shipbuilders

Specializing in building frigates, corvettes, and patrol vessels for the Indian Navy and Coast Guard. Earlier this month, GRSE signed a strategic MoU with Sweden’s Berg Propulsion to build advanced propulsion systems.

The company also signed a deal with the Danish company SunStone to build expedition cruise vessels for adventure tourism and remote sea voyages.

The company expects its order book to surpass ₹400 billion by FY26 and is exploring strong export opportunities.

At the time of writing, Garden Reach Shipbuilders stock was down 1.2% at ₹2,957.50. Year-to-date (YTD), the shares have surged 82%.

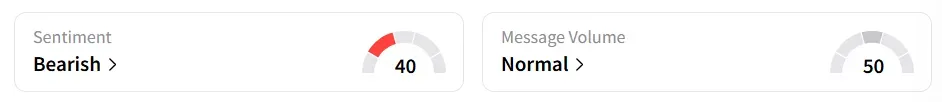

Retail sentiment on Stocktwits remained ‘bearish’.

Shipping Corporation of India

India’s largest shipping firm by capacity, SCI operates across liner, bulk, tanker, and offshore services. With a renewed focus on fleet expansion and modernization, the company is well-positioned to benefit from the recovery in global trade volumes.

The company’s stock was marginally lower at ₹222.30 at the time of writing. It has gained 6.25% year-to-date (YTD).

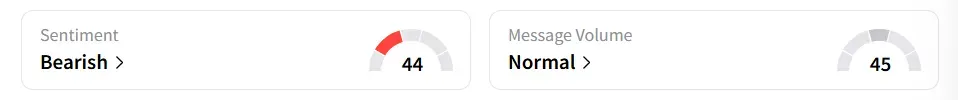

Retail sentiment on Stocktwits turned ‘bearish’ from ‘neutral’ a day ago.

Great Eastern Shipping

The country’s largest private shipping company, Great Eastern Shipping, operates in both shipping and offshore oil & gas services.

A $160 million fleet renewal program is underway, and the company remains a trusted partner for major global oil and energy clients.

The shares were trading 0.6% lower at ₹979.60, having gained 1.6% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1257075116_jpg_22f4f6802d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)