Advertisement|Remove ads.

Mazagon Dock Technicals Signal Correction; SEBI RA Sees Tactical Entry Near ₹2,600

Mazagon Dock Shipbuilders reported mixed Q1 FY26 earnings. Its short-term momentum has weakened, with the stock falling 7% in the last five sessions. But analysts believe that its long-term trend remains bullish.

Q1 net profit came in at ₹452 crore, down 35% year-on-year but up 39% sequentially. While net profit declined annually, revenue from operations rose over 11% YoY to ₹2,626 crore, though it fell more than 17% sequentially.

Technical Watch

Mazagon Dock stock is currently undergoing a short-term correction, even as its long-term trend remains structurally bullish, according to SEBI-registered analyst Harika Enjamuri.

After peaking near ₹3,370, the stock has slipped below key moving averages, notably the 9-day average at ₹2,874 and 100-day average at ₹2,977. This reflects weakness in near-term momentum. The daily relative strength index (RSI) has dropped to 25, indicating oversold conditions and the potential for a technical bounce, she added.

However, a sustained move above ₹2,975 is essential to reignite bullish sentiment. Key support lies around ₹2,650 and, if breached, the stock may slide further toward ₹2,444, Enjamuri said.

On the weekly chart, the broader uptrend is still intact despite recent profit booking. The analyst recommends a tactical entry in the ₹2,580 - ₹2,650 zone, targeting ₹3,250 over a period of four to eight weeks. A stop loss is placed at ₹2,380.

Fundamental Outlook

From a fundamental standpoint, Mazagon Dock continues to benefit from a near-monopoly in shipbuilding and robust defence sector tailwinds. Return ratios remain attractive with ROCE at 43.2% and ROE at 34%. The company also maintains a debt-free balance sheet, she said.

However, the stock has a steep valuation at 50x P/E and EV/EBITDA over 30x.

What's The Retail Mood?

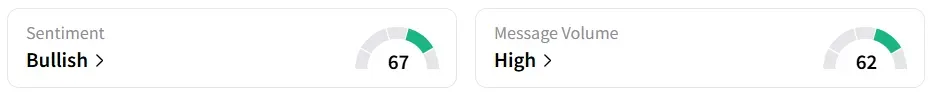

Retail sentiment turned ‘bullish’ from ‘bearish’ a week ago, amid high message volumes.

The shares were down 0.2% at ₹2,754.60

Th stock closed at ₹2,761 on Wednesday, and has gained around 24% YTD.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)