Advertisement|Remove ads.

Mobileye Stock Poised for Best Day Ever: Retail Cheers As BofA Upgrade Adds Spark To Lyft Robotaxi Deal Buzz

Shares of Mobileye Global surged more than 15% on Monday afternoon, reaching a one-month high and on track to register its biggest single-day gain ever.

The rally came after Bank of America (BofA) Securities reportedly upgraded the stock to ‘Neutral’ from ‘Underperform,’ raising its price target to $19 from $12, bringing the stock just shy of that target.

BofA said it sees Mobileye’s 2025 guidance as offering stability despite cautious views on growth and profitability.

The analysts also pointed to potential contract wins as a catalyst for positive sentiment, with the company’s 2025 outlook reducing downside risks to estimates.

Mobileye, which specializes in autonomous driving technology, had previously projected full-year revenue between $1.69 billion and $1.81 billion, and adjusted operating income between $175 million and $260 million.

However, analysts had expected higher revenue of $1.92 billion.

BofA analysts believe that while the outlook is below consensus, it limits risks and that contract wins, including deals for its SuperVision/Chauffeur system and advanced driver assistance systems (ADAS) with automakers in Japan, Europe, and the U.S., could provide a much-needed boost.

Further details about the company’s trajectory suggest that widespread adoption of its technology could take time, with BofA predicting that significant earnings growth may not occur until 2027.

The company currently faces stiff competition from companies like Alphabet’s Waymo and Tesla.

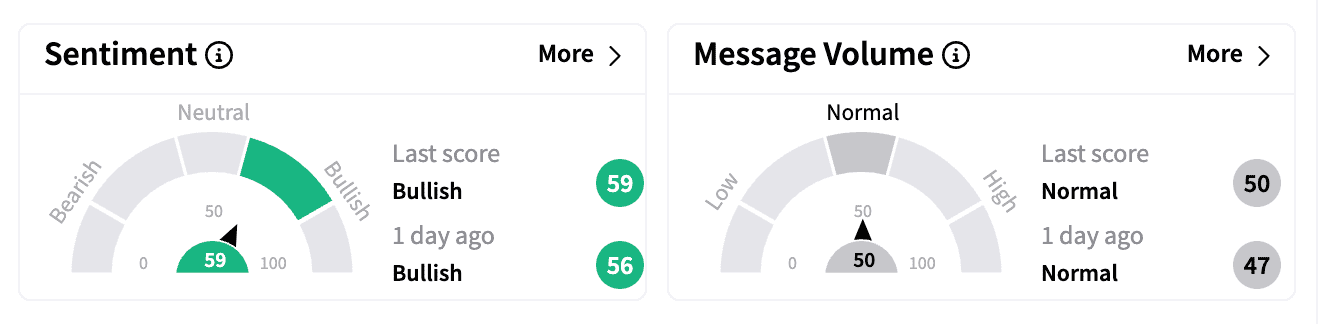

On Stocktwits, sentiment for Mobileye turned more bullish, with retail traders reacting to a major development earlier in the day.

TechCrunch reported that Lyft plans to introduce fully autonomous robotaxis, powered by Mobileye, on its platform in Dallas as soon as 2026.

Marubeni, a Japanese conglomerate, is expected to own and finance the vehicles equipped with Mobileye’s technology, which will be available on Lyft’s ride-hailing app.

While some users were optimistic, believing the stock could reach $20 or even $30 this year, others remain cautious, considering the competition and challenges ahead.

Mobileye’s stock is still down over 20% in the past year and currently trades at around 63 times its forward 12-month earnings estimate, according to Koyfin.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)