Advertisement|Remove ads.

Mark Zuckerberg's Meta Reportedly Tinkers With Employee Compensation Plan: Retail Bulls Expect ‘Big Bounce’ After 3-Day Drop

Meta Platforms, Inc. (META) reportedly cut back on stock options awards to employees amid its rising capex spending plans. Separately, the company confirmed a hike in annual bonuses to staff.

A Financial Times report, citing people familiar with the matter, said the social media giant had reduced its annual distribution of stock awards, which it calls “equity refreshers,” by 10%. The cut reportedly applies to tens of thousands of staff.

The stock refreshes are offered in addition to base salaries and annual bonuses and account for the bulk of a Meta employee's compensation, the report said, citing people familiar with the matter. They can be stacked and vested every three months over four years.

The magnitude of the reduction will reportedly depend on the employees' locations and levels within the organization.

Notwithstanding the cut, Meta still hopes to offer the highest remuneration locally, the report said.

The move comes close on the heels of a 5% global workforce reduction Meta implemented recently, citing subpar performance. The Mark Zuckerberg-led company has vouched for efficiency since post-COVID-19 macroeconomic uncertainties hurt its fundamentals in 2022. It has implemented multiple rounds of job cuts.

The recovery in ad spending in 2024 and the efficiency measures have helped Meta outperform expectations. Most recently, the Meta stock was on a record 20-session winning stream, which ended on Friday.

In an 8K filing with the SEC on Thursday, Meta said the company maintains a bonus plan that provides variable cash incentives, payable annually, to reward employees for achievements and results.

The company said, on Feb. 13 the Compensation, Nominating & Governance Committee of its board approved an increase in the target bonus percentage for all its executive officers, except the CEO, to 200% of their base salaries from 75% previously, beginning with 2025.

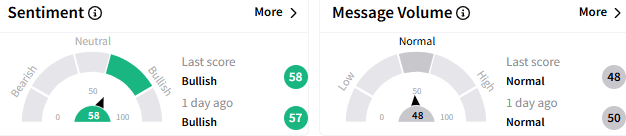

On Stocktwits, sentiment toward Meta stock remained ‘bullish’ (58/100) but the message volume stayed at a ‘normal’ level.

A retail watcher positioned for a “pretty big bounce” following the three-day sell-off.

The stock ended Thursday’s session down 1.27% at $698.84 but has been up about 19% since the start of year.

Meta hit intraday and closing highs of $740.91 and $736.67, respectively, on Friday.

For updates and corrections, email newsroom@stocktwits.com

Read Next: Five9 Stock Poised To Record Biggest Gain In Over 2 Years On AI-Powered Q4 Beat: Retail Upbeat

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1163170868_jpg_3975bd8be2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)