Advertisement|Remove ads.

Meta Stock Rises After Analyst Predicts Over 11% Upside: Retail Hopeful Of Extended Bull Run

Meta Platforms, Inc. (META) stock rose on Tuesday, with the positive sentiment underpinned by the broader market strength and a positive analyst action.

On the heels of the social media giant’s quarterly results, Argus maintained a ‘Buy’ rating on Meta’s stock and upped the price target to $775 from $686, TheFly reported. The revised price target suggests an upside of over 11%.

Argus said Meta benefits from accelerating advertising revenue and significant margin expansion due to deep cost cuts and robust cash flow.

The Menlo Park, California-based company’s quarterly results released last week showed 21% year-over-year advertising revenue growth, accelerating from 18.6% in the third quarter.

Total cost and expenses increased by 5.5% compared to the 21% overall revenue growth, emphasizing the cost discipline.

Argus analysts said investors could be spooked by Meta’s ramping generative artificial intelligence (GenAI) investments as the company takes on its mega-cap peers Microsoft Corp. (MSFT) and Alphabet, Inc. (GOOGL) (GOOG) and others to develop models and actual applications.

The analysts said Meta is already relying on GenAI to improve targeted advertising, which is one of the company’s critical monetization features.

The average analysts’ price target for Meta is $$754.82, according to TipRanks.

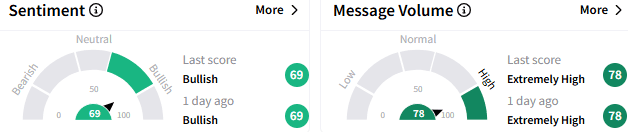

On Stocktwits, retail sentiment toward Meta stock stayed ‘bullish’ (69/100), with message volume remaining at ‘extremely high’ levels

A bullish stock watcher called for a stock split, hoping for a potential upside of up to 40%.

Another user pointed to the 700% rally in the past two years and expected an extended bull run.

Meta stock was last up 1.24% at $706.12, off a record intraday high of $710.79 hit on Thursday. The stock has added about 18% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)