Advertisement|Remove ads.

Alphabet Q4 Earnings Preview: Retail Sees Stock As Core Holding Despite Macro, Geopolitical Headwinds

Alphabet, Inc. (GOOG) (GOOGL) shares rebounded on Tuesday and raced to a record high as investors braced for the search giant’s fiscal year 2024 fourth-quarter results.

Alphabet’s results are important, especially after Microsoft Corp.'s (MSFT) disappointing quarterly showing. A strong report could support the broader market even as President Donald Trump's tariffs threaten a global trade war.

Alphabet finds itself in the crosshairs of the U.S.-China trade war as China chose to retaliate to the Trump administration’s 10% additional tariffs on Chinese imports.

China has announced tariffs on U.S. imports that will go into effect on Feb. 10 and has also placed several companies, including Alphabet’s Google, on notice for potential sanctions, Reuters reported.

Retail Upbeat

Notwithstanding the adverse geopolitical developments, retail investors are positive regarding Alphabet stock.

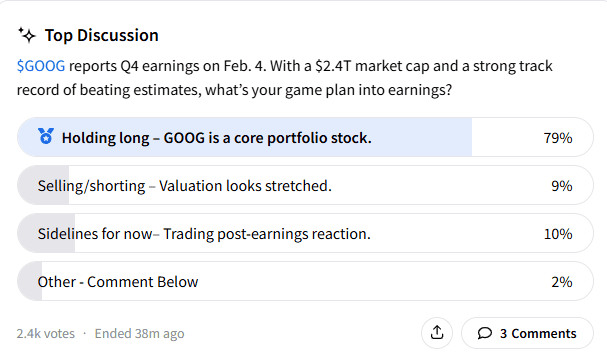

A Stocktwits poll that sought users' views found that 79% of the 2,400 respondents said they would hold the stock, supporting the thesis that it is a “core portfolio stock.”

While 10% said they remained on the sidelines, 9% said they would short the stock due to its stretched valuation. Alphabet stock gained over 6% this year, following a 36% jump in 2024.

A stock watcher on the platform predicted a move past $217 following the earnings release.

Another shared a chart showing the stock breaking out of the recent trading range and said technicals pointed to strength.

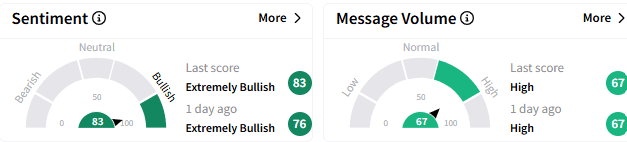

Retail sentiment among Stocktwits users was ‘extremely bullish’ (83/100), with message volume staying ‘high.’

Q4 Expectations

Alphabet is widely expected to report fourth-quarter earnings per share (EPS) of $2.13 on revenue of $96.68 billion. This compares to the year-ago EPS and revenue of $1.64 and $86.31 billion, respectively, and the third quarter’s $2.12 and $88.27 billion.

Citing Wedbush’s fourth-quarter digital advertising survey, analyst Scott Devitt said in a recent note that advertising demand for the Search business and YouTube remains strong.

However, he cautioned that Alphabet will unlikely materially outperform advertising revenue growth expectations due to forex headwinds and more challenging comps in the fourth quarter and 2025.

The analyst is positive about the Cloud business and the potential for more aggressive cost cuts under Alphabet’s new CFO Anat Ashkenazi.

Wedbush’s estimates are as follows:

- Total revenue: $96.8 billion (12.2% YoY growth)

- Google Search revenue growth: 11.3%

- YouTube ad revenue growth: 11.5%

- Cloud revenue growth: 32.3%

- Operating margin: 31%

Devitt has an ‘Outperform’ rating and a $220 price target for Alphabet stock. The analyst sees the valuation as reasonable, given the stock trades roughly in line with the market multiple.

“We think there is a case for multiple expansion for Alphabet in the coming quarters and years as investors gain more comfort related to regulatory risk and the impact of generative AI on Google Search,” he added.

Devitt said he would look forward to management commentary on capital expenditure, DeepSeek’s impact and whether Trump’s tariffs will have any impact on the broader industry and Google’s spending plans.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_shopify_signage_resized_a95ee6ba6d.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)