Advertisement|Remove ads.

MicroStrategy Stock Dips On $42B Bitcoin Strategy: Wall Street Backs Move While Retail Stays Wary

MicroStrategy Inc. ($MSTR) shares fell nearly 3% as markets opened Thursday even as analysts increased their price targets following the firm's commitment to further expanding its Bitcoin ($BTC.X) holdings amid declining revenue.

Maxim Group boosted its price target from $193 to $270, citing MicroStrategy's ongoing Bitcoin accumulation and a promising outlook for cloud revenue. The brokerage also increased its 2025 Bitcoin price expectation to $200,000, highlighting reduced regulatory risks.

TD Cowen and Benchmark echoed this sentiment, raising their price targets to $300.

BTIG also raised its target, from $240 to $290, maintaining a ‘Buy’ rating. The brokerage reiterated confidence in MicroStrategy’s strategy of leveraging capital to enhance its Bitcoin holdings, further justifying the stock's premium compared to the market value of its Bitcoin assets.

In its third-quarter post-earnings call, MicroStrategy declared itself a “Bitcoin treasury company” and outlined a plan to raise $42 billion in capital over the next three years through a balanced approach of $21 billion in equity and $21 billion in fixed-income securities, dubbed the “21/21 Plan.”

“By using proceeds from equity and debt financings, as well as cash flows from our operations, we strategically accumulate Bitcoin and advocate for its role as digital capital,” said MicroStrategy CEO Phong Le during the call.

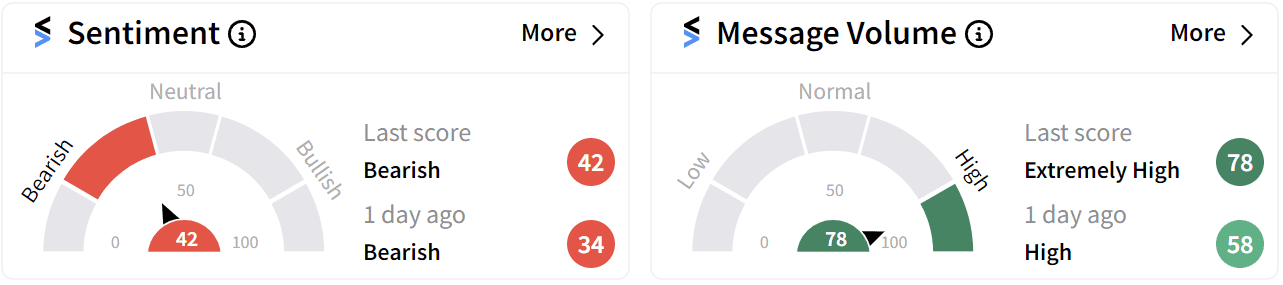

Despite Wall Street’s enthusiasm, retail sentiment on Stocktwits remains in the ‘bearish’ (42/100) territory, backed by ‘extremely high’ (78/100) chatter.

However, some users on the platform believe that MicroStrategy has a significant upside since the result of the upcoming 2024 US Election is unlikely to dampen Bitcoin’s prospects for the future.

“The embrace of Bitcoin by major political parties is a second milestone. I think we can see movement toward normalization of Bitcoin,” said former CEO and current Executive Chairman at MicroStrategy, Michael Saylor.

In Q3 2024, MicroStrategy reported a revenue of $116.1 million, a 10.3% decline year-over-year (YoY), falling short of Wall Street's estimate of $121.5 million. The company faced a larger-than-anticipated loss of $1.72 per share instead of the expected $0.12 loss, according to Stocktwits data.

MicroStrategy remains the largest corporate holder of Bitcoin, owning 252,220 BTC valued at $18 billion, and acquired an additional 25,889 BTC during the third quarter for $1.6 billion.

The company’s stock has gained more than 250% so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)