Advertisement|Remove ads.

Micron Technology To Stop Selling Server Chips To China Data Centers: Report

Micron Technology Inc.(MU) is reportedly planning to withdraw from the Chinese data center chip market following a prolonged fallout from a 2023 regulatory ban that blocked its products from being used in key infrastructure in China.

According to a Reuters report, the move comes after the company failed to recover lost business in the wake of the ban and intensifying tech tensions between the U.S. and China.

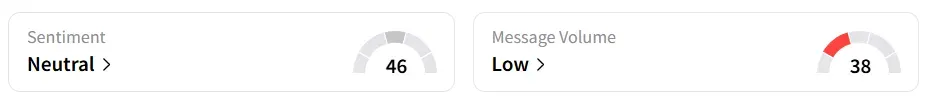

Micron Technology stock inched 0.8% lower on Friday morning. On Stocktwits, retail sentiment around the stock improved to ‘neutral’ from ‘bearish’ territory amid ‘low’ message volume levels.

The stock experienced a 248% increase in user message count in 24 hours.

The U.S.-based chipmaker will stop supplying server chips to Chinese data centers but will maintain its business with certain Chinese firms operating data facilities abroad, including major PC manufacturer Lenovo Group, the report cited.

Micron was the first American semiconductor firm directly targeted by Beijing, widely interpreted as retaliation for Washington’s curbs on China’s chip industry. Since then, Nvidia Corp. (NVDA) and Intel Corp. (INTC) have faced similar scrutiny from Chinese regulators, according to the report.

Mizuho has boosted its price target on Micron to $240 from $195, maintaining an ‘Outperform’ rating on the stock, according to TheFly. The firm pointed to accelerating demand for artificial intelligence infrastructure and a strengthening memory pricing environment as key factors behind its revised outlook.

The firm highlighted that the surge in AI activity, driven by larger and more advanced multimodal models, continues to fuel stronger-than-expected demand.

Micron stock has gained over 137% in 2025 and 78% in the last 12 months.

Also See: Datadog Draws Wall Street’s Praise Ahead Of Q3 Earnings

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)