Advertisement|Remove ads.

MicroStrategy Stock Rockets To Fresh All-Time Highs On Bitcoin Rally, Massive $2B BTC Purchase: Retail Confidence High

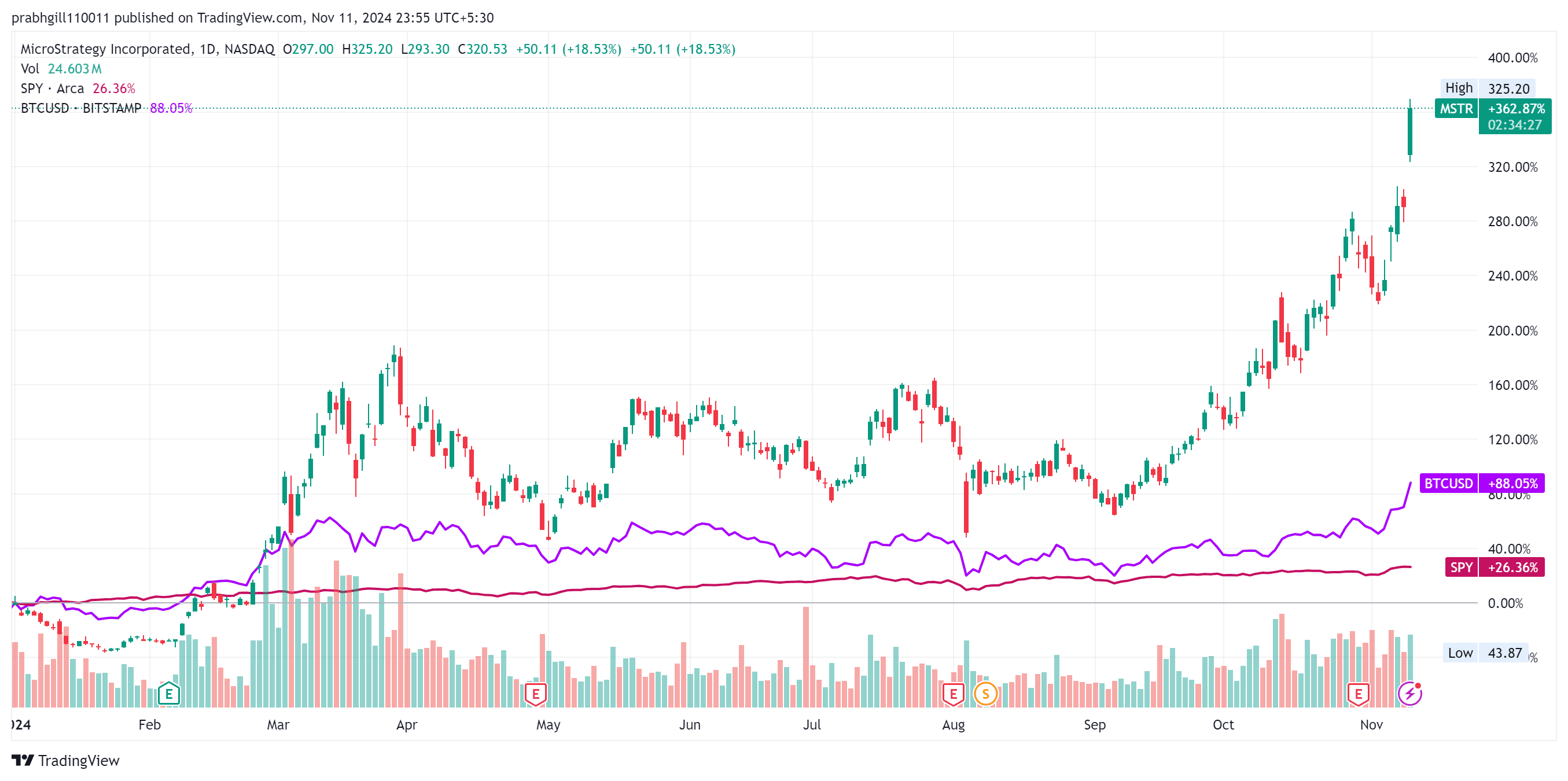

MicroStrategy Inc. ($MSTR) surged over 20% on Monday, reaching a fresh record high of $325.28, as Bitcoin ($BTC.X) climbed to an all-time peak of $84,962.40, boosting the value of MicroStrategy’s substantial cryptocurrency holdings.

MicroStrategy also disclosed that it bought about 27,200 Bitcoin for around $2.03 billion on Monday.

It marks the company's largest purchase of Bitcoin since it began buying the digital asset and snapped up 29,646 Bitcoin in December 2020,

The latest purchase, completed between Oct. 31 and Nov. 10, raised MicroStrategy’s Bitcoin holdings to around $23.6 billion, based on Monday’s record price of more than $84,500 for the digital currency.

The company’s strategy to invest heavily in Bitcoin has led its stock to outperform every major US stock since mid-2020, including AI frontrunner Nvidia Corp.

Shares of MicroStrategy have rocketed 2,300% since August 2020, compared to Bitcoin’s rise of roughly 630% over the same period.

MicroStrategy’s latest purchase of Bitcoin makes it the largest public corporate holder of the cryptocurrency, second only to BlackRock’s U.S.-based exchange-traded fund ($IBIT).

Bitcoin’s recent boost has been partly attributed to President-elect Donald Trump’s support for the asset class.

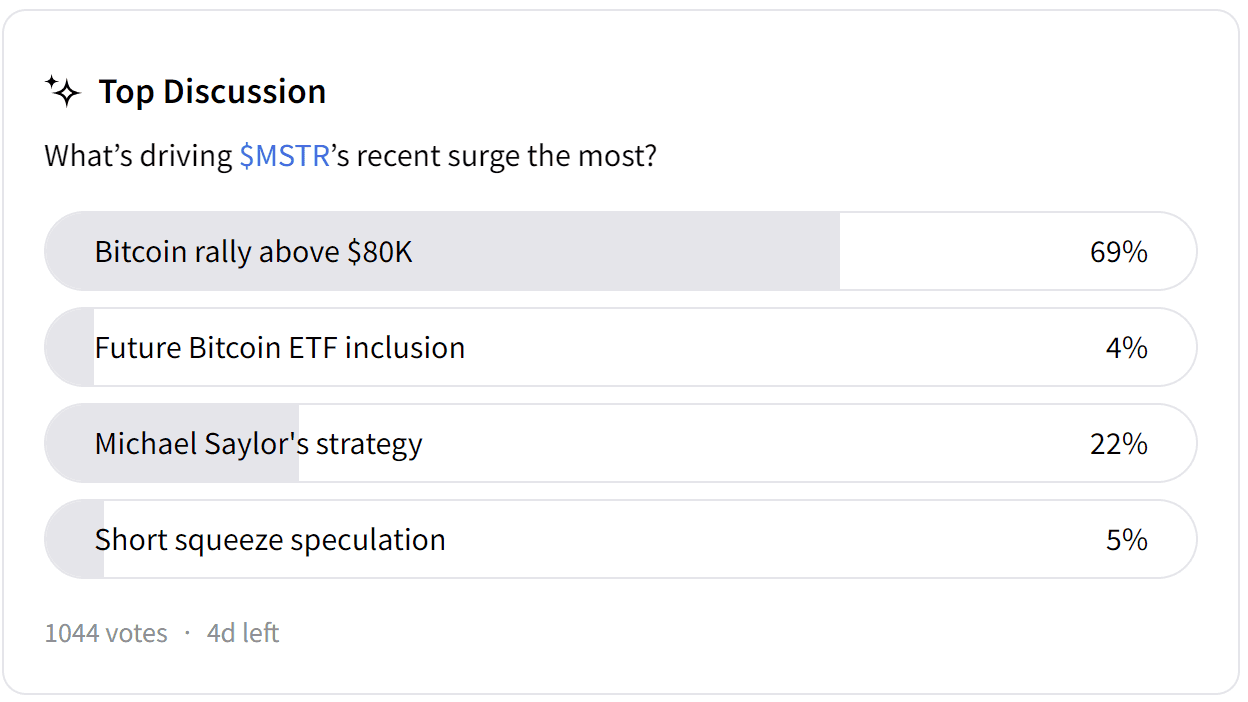

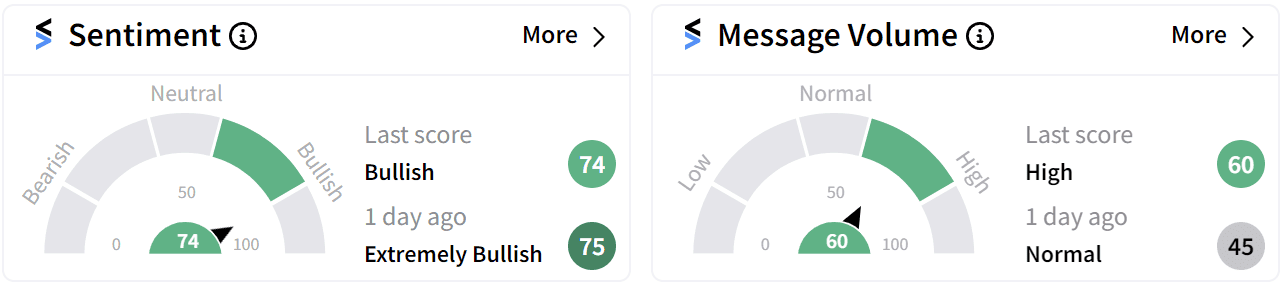

Retail sentiment around MicroStrategy dipped to ‘bullish’ (74/100) on Monday from ‘extremely bullish’ on Friday with an uptick in chatter to ‘high’ (60/100).

The number of watchers on the stock has doubled over the past year, while also being one of the most active stocks on the Stocktwits platform.

In its third-quarter post-earnings call, MicroStrategy declared itself a “Bitcoin treasury company” and outlined a plan to raise $42 billion in capital over the next three years through a balanced approach of $21 billion in equity and $21 billion in fixed-income securities, dubbed the “21/21 Plan.”

Microstrategy currently owns over 1% of Bitcoin’s total supply, capped at 21 million tokens.

For updates and corrections email newsroom@stocktwits.com.

Read more: MicroStrategy Stock Dips On $42B Bitcoin Strategy: Wall Street Backs Move While Retail Stays Wary

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ryanair_michael_oleary_jpg_d2a378f59e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_target_logo_resized_jpg_3025bd9bb0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_job_seekers_florida_resized_jpg_742e535d49.webp)