Advertisement|Remove ads.

Microvast Sparks Retail Excitement As Stock Hits 3.5-Year Highs

Microvast Holdings, Inc. (MVST) stock hit 3.5-year highs on Wednesday, gaining spotlight on continued strength from China’s proposed restrictions on Lithium battery components export.

China’s new curbs are likely to limit global supply, increasing demand for non-Chinese producers.

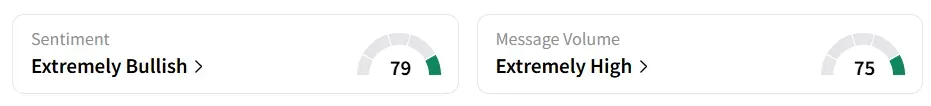

At the time of writing, Microvast’s stock pared some of the gains and traded over 8% higher. The stock was the third-most trending equity ticker on Stocktwits. Retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day amid ‘extremely high’ message volume levels.

The stock experienced a 696% increase in user messages over the past month. A bullish Stocktwits user said the stock is still undervalued.

Another user highlighted the possible catalysts for the stock in the near future.

According to a Reuters report, Beijing will require exporters to get special permits to ship certain advanced lithium-ion batteries, cathodes, graphite anode materials, and related technology. The new export controls will start on November 8.

Microvast's true all-solid-state battery technology (ASSB) utilizes a bipolar stacking architecture that enables internal series connections within a single battery cell.

On October 3, Microvast announced plans for fresh capital through an at-the-market (ATM) equity offering worth up to $125 million. The company intends to use the net proceeds from the offering for a range of general business purposes, including reducing existing debt, increasing working capital, and pursuing strategic acquisitions.

Microvast stock has gained over 182% in 2025 and over 2,690% in the last 12 months.

Also See: Uber Wins Guggenheim Backing Over Strong Upside Potential

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)