Advertisement|Remove ads.

Mobileye Shares Tanks Nearly 7% — What Does The Street Think About The Stock?

- Raymond James lowered the price target on Mobileye to $16 from $19 with an ‘Outperform’ rating on the shares after its Q4 results.

- RBC Capital lowered its price target to $13 from $14 with a ‘Sector Perform’ rating on the shares, citing lower-than-expected FY26 EBIT guidance.

- Meanwhile, HSBC analyst Pushkar Tendolkar downgraded Mobileye to ‘Hold’ from ‘Buy’ with a price target of $11.

Shares of Mobileye Global Inc. (MBLY) fell nearly 7% on Friday amid a slew of price target cuts from Wall Street analysts after the company reported its fourth-quarter results on Thursday.

Raymond James, RBC Capital, Morgan Stanley, UBS, Canaccord, Goldman Sachs, and Mizuho were among the analysts who lowered targets on the advanced driver assistance systems (ADAS) company.

Street Consensus

Raymond James lowered the price target on Mobileye to $16 from $19 with an ‘Outperform’ rating on the shares after its Q4 results, according to TheFly. The analyst said the company’s FY26 guidance reaffirmed it as a transition year, but the firm sees room for upside in late 2026.

RBC Capital lowered its price target on the company to $13 from $14 with a ‘Sector Perform’ rating on the shares, citing lower-than-expected FY26 earnings before interest and tax (EBIT) guidance. The analyst said that while it remains constructive on Mobileye’s robotaxi and humanoid platforms, it also sees near term headwinds from OEM insourcing on advanced autonomy.

Morgan Stanley analyst Andrew Percoco cut the firm's price target to $12 from $13 and kept an ‘Equal Weight’ rating on the shares, adding that the firm sees downside risk extending into 2027 estimates.

UBS lowered the firm's price target to $12 from $13 with a ‘Neutral’ rating on the shares while Canaccord cut its price target to $24 from $30 with a ‘Buy’ rating on the shares.

Goldman Sachs lowered Mobileye’s price target to $12 from $13 and kept a ‘Neutral’ rating on the shares and Mizuho lowered its target to $11 from $12 with a ‘Neutral’ rating.

Meanwhile, HSBC analyst Pushkar Tendolkar downgraded Mobileye to ‘Hold’ from ‘Buy’ with a price target of $11.

Latest Results

The company posted Q4 revenue of $446 million, beating analyst estimates of $431.85 million by about 3% as per data from Fiscal.ai, and posted a net loss of $127 million, compared to $71 million of loss posted in the same period last year.

The company said that its latest quarterly revenue fell 9% compared to Q4 2024, primarily due to an 11% reduction in EyeQ SoC volumes caused by a balancing of supply and demand that resulted in tighter-than-normal inventory levels at Tier 1 customers exiting 2025.

Meanwhile, Mobileye provided a revenue guidance of between $1.9 billion and $1.98 billion for FY26, compared with a street expectation of $1.96 billion based on 24 analyst estimates on data from Fiscal.ai.

The company said it expected an adjusted operating income of between $170 million and $220 million, compared to street expectations of $195 million.

How Did Stocktwits Users React?

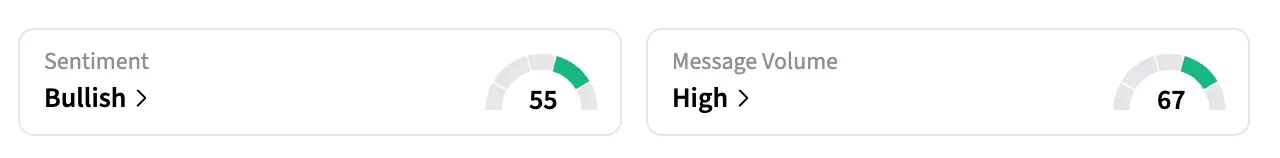

On Stocktwits, retail sentiment around MBLY shares jumped to ‘bullish’ territory from ‘neutral’ over the past day, amid ‘high’ message volumes.

Shares of MBLY declined over 41% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aurinia_pharmaceuticals_jpg_021df4af64.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)