Advertisement|Remove ads.

Ultragenyx Stock Eyes Best Day In 17 Months As Wall Street Shifts Focus To 2026 Pipeline After Bone Disease Trial Miss

- Analysts cut price targets after the Phase 3 miss but largely maintained positive ratings and highlighted secondary endpoint strength.

- The focus has shifted toward Ultragenyx’s broader pipeline and upcoming regulatory and clinical milestones.

- Retail sentiment stayed positive as investors reassessed the magnitude of the selloff.

Shares of Ultragenyx Pharmaceutical (RARE) surged nearly 12% and were on track for their strongest session in about 17 months on Tuesday, as investors looked past analyst actions following the company’s Phase 3 setback in brittle bone disease.

The move comes a day after the stock plunged more than 40% when Ultragenyx said its Phase 3 Orbit and Cosmic studies of Setrusumab (UX143) in osteogenesis imperfecta did not meet the primary endpoint of reducing annualized fracture rates, though both trials showed improvements in bone mineral density.

JPMorgan Removes Focus List Status

At JPMorgan, analyst Anupam Rama removed Ultragenyx from the firm’s Analyst Focus List, saying he was “surprised and disappointed” by the trial outcome. Rama said he expects a sentiment overhang on the shares following the miss and kept an ‘Overweight’ rating.

Wells Fargo: ‘Too Soon To Throw In The Towel’

Wells Fargo analyst Benjamin Burnett lowered his price target to $45 from $65 and kept an ‘Overweight’ rating. Burnett said Setrusumab achieved statistical significance on bone mineral density, the secondary endpoint, in both studies and described the stock’s risk-reward as “highly favorable” ahead of potential FDA feedback. He added it was “too soon to throw in the towel,” citing key opinion leader checks indicating bone mineral density is viewed as an objective measure of benefit.

Jefferies Looks To 2026 Pipeline Catalyst

At Jefferies, analysts cut their price target on Ultragenyx to $63 from $114 while keeping a ‘Buy’ rating. The firm said the Setrusumab miss sent shares sharply lower but expects a rebound in 2026 as investors position for a Phase 3 readout in Angelman syndrome.

Other Target Cuts Maintain Ratings

Barclays lowered its price target to $44 from $50 and kept an ‘Overweight’ rating, citing the failure of the Orbit and Cosmic studies to achieve statistical significance on the primary endpoint.

Citi cut its target to $50 from $103 and maintained a ‘Buy’ rating, calling the trial failure a “significant surprise” and removing Setrusumab revenue from its model.

Cantor Fitzgerald reduced its target to $84 from $105 and reiterated an ‘Overweight’ rating.

Pipeline Focus And Cost Cuts

Truist analyst Joon Lee said the focus now shifts to Apazunersen for Angelman syndrome, with Phase 3 Aspire topline data expected in the second half of 2026. Lee kept a ‘Buy’ rating with a $90 price target and said his work suggests Apazunersen has a higher probability of success than Setrusumab in osteogenesis imperfecta.

Ultragenyx also said it will significantly reduce expenses after reviewing planned operations, a step investors appeared to factor into Tuesday’s rebound as attention turned to longer-term pipeline milestones.

How Did Stocktwits Users React?

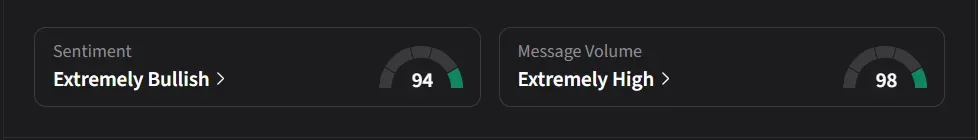

On Stocktwits, retail sentiment for Ultragenyx was ‘extremely bullish’ amid ‘extremely high’ message volume.

One bullish user said the stock could trade in the $25–$30 range next.

Another user said the recent move looks like a “correction after over reaction,” pointing to Ultragenyx’s FDA-approved portfolio including Dojolvi, Crysvita, and Mepsevii.

Ultragenyx’s stock has declined 48% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)