Advertisement|Remove ads.

Mosaic Company Down After Slashing Phosphate Sales Volumes Forecast: Retail Bearish

Shares of Mosaic Company (MOS) closed down 4.4% at $34.80 on Friday, after the company lowered its phosphate sales volumes for the second quarter and full year 2025.

Mosaic revised its second-quarter phosphate sales volume forecast to 1.5–1.6 million tonnes, down from an earlier estimate of 1.7–1.9 million tonnes. Full-year phosphate production is expected to reach 7.0–7.3 million tonnes, reduced from 7.2–7.6 million tonnes.

The company expects a 20% quarter-on-quarter increase in output at its New Wales facility, but delays in commissioning new gypsum handling systems have capped production.

Gypsum handling systems have been a bottleneck at the facility, limiting the phosphoric acid plants' ability to operate at full capacity.

In Louisiana, unplanned repairs extended outages, but operations are expected to normalize in Q3 at a 1.4 million tonne rate.

Potash sales and production guidance remain unchanged at 2.3–2.5 million tonnes for Q2 and 9.0–9.4 million tonnes for the year.

Mosaic also increased its phosphate price guidance for the second quarter, citing strong market conditions. Potash prices remain unchanged.

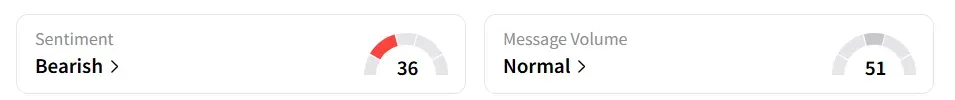

Retail sentiment on Stocktwits was ‘bearish’, compared to ‘neutral’ a month earlier.

One user cited panic selling as the cause of the share price drop.

Mosaic’s stock has risen nearly 42% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)