Advertisement|Remove ads.

After Meta’s Recent Pullback, Most Retail Investors Expect Stock To Stall Downtrend In New Week

Meta Platforms, Inc. (META) stock has shed nearly 8% from its all-time intraday high of $740.91, which it reached on Feb. 14. Retail investors are bracing for more pain in the near term.

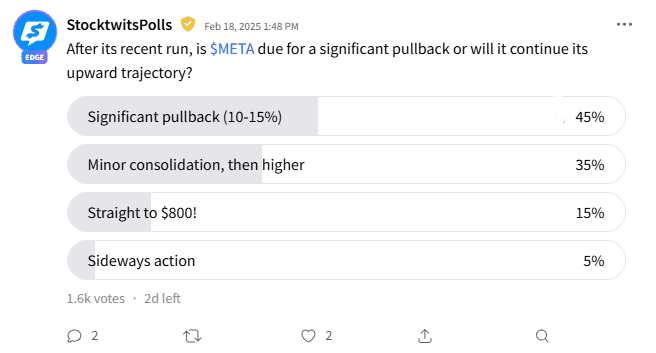

A Stocktwits poll found that 45% of the 1,600 respondents predicted a “significant” 10-15% pullback. The poll was initiated just after the Meta stock snapped its record 20-session winning run. A sizable 35% expected a consolidation move in the near term before the stock takes off.

While 15% hoped for a blastoff to the $800 mark, the remaining 5% rooted for an extended “sideways” action.

Meta’s fundamentals have improved since bottoming in 2022, thanks to a resurgence in ad spending, efficiency measures implemented by the company and its artificial intelligence initiatives.

The company reported better-than-expected December quarter results in late January, thanks to a surge in advertising revenue to $48.39 billion. The company issued lukewarm guidance and projected a substantial increase in its capital spending plans to $60 billion to $65 million from $39.23 billion in 2024.

Meta trades at a forward P/E multiple of 26.88, with the valuation reasonable relative to the S&P 500’s 30.09.

Retail sentiment toward the Meta stock among Stocktwits users remained ‘bullish’ (59/100), but the message volume stayed low.

A watcher said Meta stock will, without any doubt, trade back above $700 this week.

Another said the stock is at bargain basement price following the recent pullback.

After rising 66% in 2024, Meta has rallied 16.7% so far this year. The TipRanks-compiled consensus stock price target for Meta stock is $746.61, suggesting roughly 12% upside potential.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strategy_logo_OG_jpg_fa4e1a7d04.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206312585_jpg_1a7c050dff.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232490693_jpg_6d25778555.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_4_jpg_bb96bc484b.webp)