Advertisement|Remove ads.

Trump Media Proposes To Reincorporate In Florida, Joining Corporate Exodus Out Of Delaware: Retail Stays Downbeat

Trump Media & Technology Group Corp. (DJT), which owns the Truth Social platform, seeks to move its place of incorporation away from Delaware to Florida.

In the proxy statement filed with the SEC in connection with the virtual 2025 annual meeting scheduled for April 30, Trump Media & Technology Group (TMTG) has sponsored a proposal regarding the Florida move.

TMTG has its principal businesses in Florida. In addition to Truth Social, the company owns Truth+ streaming platform and the Truth.Fi fintech brand.

TMTG CEO and Chairman Devin Nunes said, “We are committed to Florida, which has an outstanding business climate and shows tremendous respect for free enterprise.”

“We look forward to uniting our legal home with our physical home as we explore possibilities for mergers, acquisitions, partnerships, and other growth.”

The proposed move aligns with the recent trend of Delaware-incorporated companies moving out. Elon Musk’s flagship electric-vehicle venture, Tesla and his SpaceX business moved their state incorporation to Texas after a Delaware Chancery judge canceled Musk's $56 billion pay plan.

A Wall Street Journal said in late January that Meta Platforms, Inc. (META) is contemplating heading out of Delaware and is considering Texas or other states for incorporation.

The development has been precipitated by the perception that the state is too investor-friendly.

Last week, Delaware lawmakers proposed changes to a state law that would limit shareholder lawsuits.

TMTG has also been at the receiving end. In September, the Chancery Court ruled that ARC Global, one of the investors that helped TMTG go public, should be paid more than half a million additional shares before the lock-up period on insider sales expired.

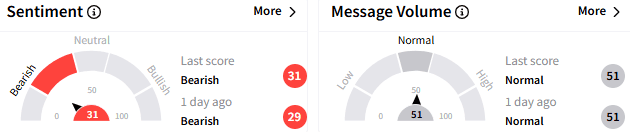

Retail sentiment toward TMTG stock among Stocktwits users remained ‘bearish’ (31/100), with the message volume staying ‘normal.’

A stock watcher said TMTG isn’t a real company and exists merely to boost President Donald Trump’s ego.

TMTG stock ended Friday’s session down 3.05% at $26.99. The stock has lost over 30% since the start of the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: UK's Cineworld Reportedly Eyes IPO Or Merger With AMC Or Cinemark: Retail Isn't Biting Yet

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252194207_jpg_9605cd50d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)