Advertisement|Remove ads.

Motorola Stock Struggles Despite RapidDeploy Acquisition, But Retail Stays Bullish

Motorola Solutions (MSI) edged down 0.5% in pre-market trading on Monday after announcing its acquisition of RapidDeploy, a cloud-native provider of Next Generation 911 (NG911) solutions for emergency response.

The stock is trading at six-month lows.

According to Motorola, the acquisition strengthens its position in the emergency response technology market.

RapidDeploy's software integrates with Motorola’s existing Rave suite, facilitating public safety data aggregation, intelligence sharing, and notifications.

Motorola plans to incorporate RapidDeploy’s technology into its VESTA 911 call-handling software and AI-powered VESTA NXT platform to enhance emergency dispatchers' speed and efficiency.

The company said the new integration will provide 911 operators real-time data, including GPS locations, indoor floor plans, and communication streams such as text, chat, and live video.

These capabilities can be directly shared with first responders in the field, improving situational awareness.

RapidDeploy currently serves more than 1,600 emergency communication centers across 24 U.S. states.

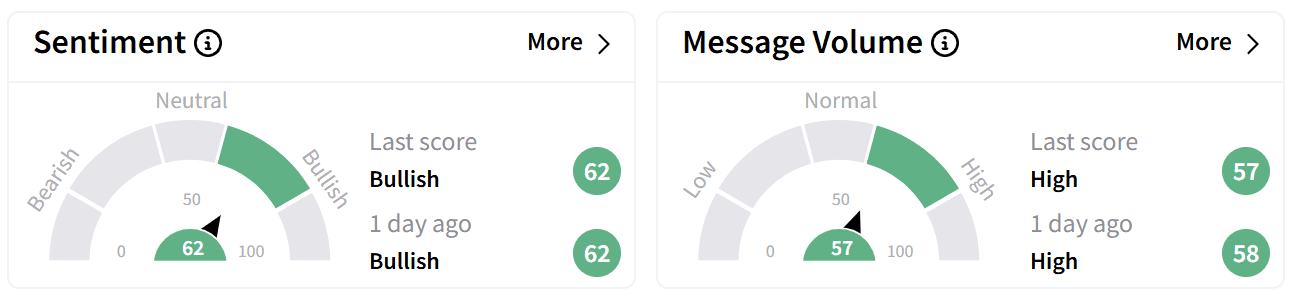

Retail sentiment on Stocktwits remained ‘bullish’ on Monday, with message volumes around Motorola stock at ‘high’ levels.

According to the Koyfin data, Motorola’s shares are currently trading nearly 17% below their 52-week high of $507.82.

The stock has declined 1.2% over the past six months and is down more than 9% year-to-date. Its steepest single-day drop occurred on Feb. 14, when shares fell 5.9% following the company’s fourth-quarter (Q4) earnings report.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Ethereum Falls As Bybit Gets Hit By The Biggest Crypto Hack in History – Retail Traders Fume

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)